One company that hasn’t been covered much in the hallowed pages of CFDs Weekly to date is Swissquote. There is no real reason for that other than nothing has cropped up to make them seem worth covering.

But as they are a big player in the sector and released their final year results relatively recently, I figured it would be an opportune moment to see if there is anything interesting going on in Switzerland (beyond failing banks). So here goes.

Swissquote increased revenue from interest by 364.7% but revenues fell by 15.6%

A key point from IG’s latest results was that interest accounted for 5% of total revenues, having previously been 0. For Swissquote that figure is even more dramatic.

The broker generated 18% of its total revenues from interest last year, or CHF 73.5m in more tangible terms, versus CHF 408m in total revenue. That was a nearly five-fold increase on 2021 when the company produced 15.8m in revenue from interest. Again, this makes you wonder if we will see Swissquote or another broker offering a cash product to get more clients.

Higher interest was a boon for the company too as it helped offset a sizeable drop in trading activity, which in turn led to lower revenues. However, even with the increase in interest, the company still saw revenues fall from CHF 472m to CHF 408m. Profit fell from CHF 223m to CHF 186m.

Client cash holdings hit 18% of assets

Part of the reason Swissquote was able to make more money from interest were its clients’ cash holdings.

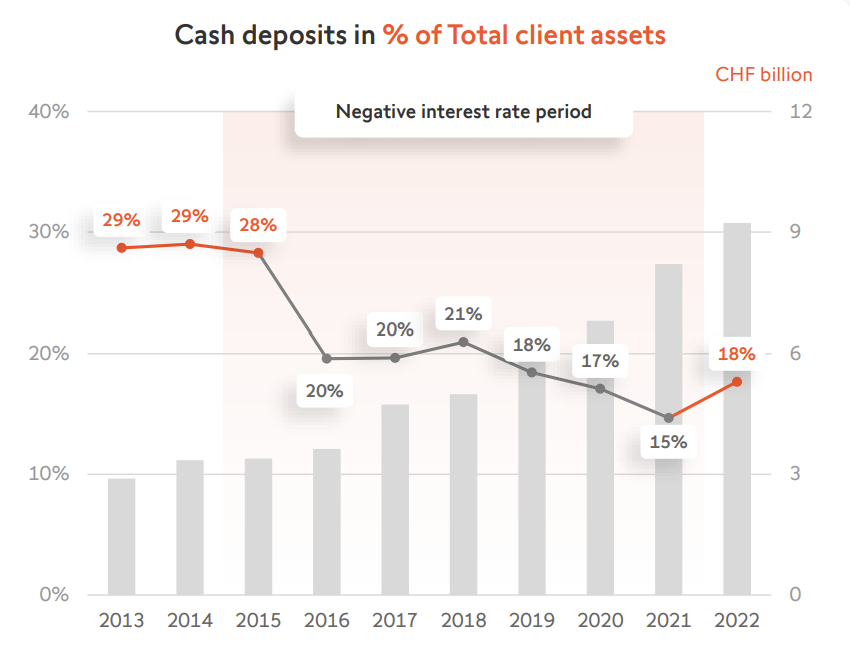

Clients parked approximately CHF 9.4bn in cash with the company last year. This represented 18% of total client assets, which stood at CHF 52.2bn.

This is not the highest level they’ve been at proportionally. As you can see from the image below, if you look back at the past decade, then there have been several periods where clients held a higher proportion of net assets in cash.

However, there are two key differences today. One is that the amount of cash is at its highest level ever. So even if there have been periods where the ratio of cash / investments was higher, the broker has still never held this much in cash deposits before.

The other more obvious difference is that rates have not been at a level in at least a decade that would make generating interest on cash holdings particularly viable.

What that means is Swissquote has more cash holdings than ever before and rates are at a level where they deliver meaningful returns.

As an aside, one other point to note is that Swissquote launched share lending last year via an entity in Luxembourg. It’s not clear how much they’re making from it but this is something we’ll probably see more of from players that have a meaningful share trading offering.

Diversification pays off

Of course, you could go another level below this and ask, how was Swissquote able to get clients to deposit that amount of cash?

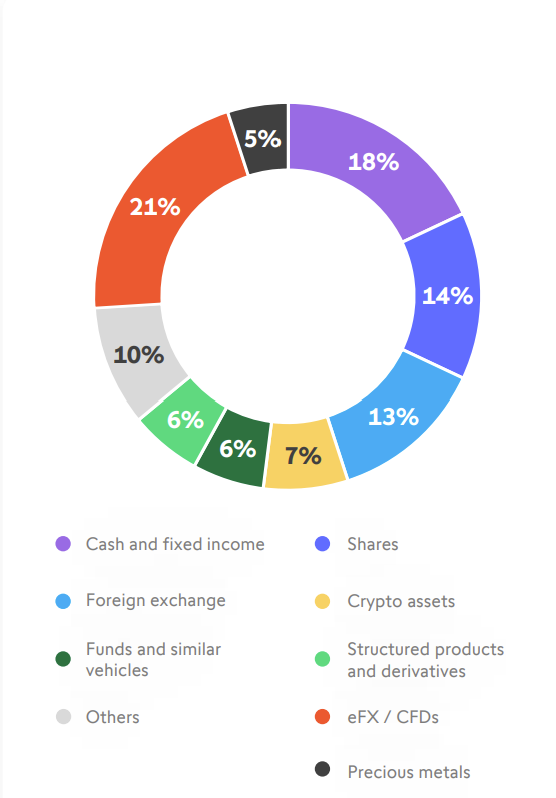

I think the answer to this lies in the revenue split that the company has. If you look at the below, you can see that leveraged FX and CFDs made up 21% of revenues. This is potentially misleading as the 5% which is attributed to ‘precious metals’ appears to also be primarily derived from CFDs.

Nonetheless, what this shows is that Swissquote has an offering which makes it appealing to a broader audience than people punting on markets. That seems to have worked given the average Swissquote customer has CHF 96,846 with the broker (or $105,256 in dollar terms).

In contrast, if you look at CMC Markets’ leveraged business at the end of their last financial year, the average deposit was £8,508. But then their Australian stockbroking business had an average account size of about $217,000*.

This is not exactly a like-for-like comparison because you still make a lot of money from small deposits in CFDs, whereas you need a lot of AUM to start making money from stockbroking.

But the point here is that in market conditions like today, having stockbroking and other products means a client is going to be more willing to park cash with you, helping you get another source of revenue in the form of interest. If you just offer CFDs then they probably won’t. As a result, my estimate is that only CMC, Saxo and maybe IG will be able to produce similar levels of interest-based revenue over the next couple of years.

Crypto is way down

Moving away from interest and onto cryptocurrency. Swissquote launched its crypto exchange at the end of last year but has offered trading in cryptos for much longer.

It will probably come as a surprise to no one that revenues from crypto trading fell off a cliff for the broker last year. Having hit over CFH 100m in 2021, last year sales from crypto dropped to CHF 27.7m.

This would fit with other things yours truly has heard from one other major provider in the sector, which has seen a massive drop off in its cryptocurrency-based revenues.

Still, considering cryptos have a fair value of zero, making about $30m from them isn’t bad going.

Big in the Middle East

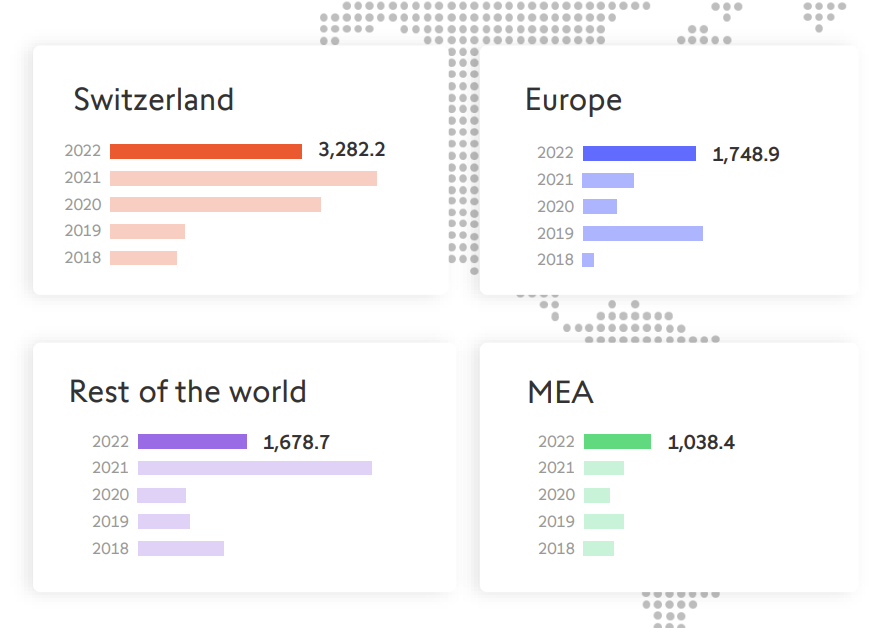

One other striking thing from the report is the level of deposits Swissquote got from the Middle East and Africa last year. You can see new client deposits from different regions in the picture below.

Given it was the smallest contributor, the MEA region may not look that impressive. But then if you think about the size of the target area it is a lot.

What do I mean by that? Well, Swissquote’s only regulated entity in the MEA region is in Dubai. It’s plausible they’re doing offshore business in Africa but I doubt it and can’t see any evidence that’s the case. And even if they were, it would probably constitute a small amount of overall deposits.

That means their efforts are probably concentrated on the Gulf countries. If you look at IG’s latest report, this was the region with the highest average deposits. This was also the area that Capital.com CEO Peter Hetherington told us the broker was doing particularly well in.

Who are these people? Legend has it that it’s basically just all the rich people that have washed up in Dubai and the other emirates. There aren’t lots of them but there are still plenty to go around, which is why so many brokers today are targeting the region.

* Note that this is my calculation based on CMC’s last annual report. The figure is derived by dividing total AUM by account numbers. However, it does seem high to me and the way the figures are reported is a bit odd, so this could be wrong.