A reminder that we’ll be having a meet up in the City on October 13th. Will confirm the location next week. Let me know on LinkedIn or via david@cfdsweekly.com if you’d like to join.

And now on to this week’s article…

Earlier this year, the Financial Times released a great podcast series investigating the porn industry. One thing that struck me were the similarities with the CFD trading sector – shady owners trying to hide their identity, problems with banks, and lots of people getting screwed.

The main ‘finding’ of the series was that payments providers have become the rulemakers in the porn industry. Failing to adhere to the standards they set means you are probably going to find your site cut off from access to customers’ money.

As a result the payments part of the business has become a major pinch point for companies. You can do lots of things but if you mess with Visa or Mastercard then your company is effectively going to lose access to any form of revenue.

All of this will probably be very familiar to people in the CFD sector, who have long had to contend with difficulties accessing banks and payments providers. However, over the weekend a new problem arose.

As most readers are probably aware, MetaQuotes revealed that apps for MetaTrader 4 and MetaTrader 5 had been removed from Apple’s App Store. The platform provider sent an email to clients saying:

“Following a unilateral decision of Apple which was outside the control of MetaQuotes, MetaTrader 4 and MetaTrader 5 for the iOS operating system will not be available for download in the Apple App Store, as of today.

MetaQuotes is taking all the actions required, in an effort to restore the apps the soonest [sic] possible.”

Since the news came out, and because MetaQuotes has not said anything publicly, a number of theories have begun to circulate as to why this has happened. One is that this is because the owner of MetaQuotes is Russian.

Unless MetaQuotes is supplying the Russian Armed Forces with software, which might explain their relatively poor performance on the battlefield, it seems highly unlikely this is the case. It is hard to see how existing sanctions would apply to MetaQuotes.

The company’s other apps remain on the Apple App Store, something which would probably not be the case if the removal was due to sanctions. Moreover, MetaQuotes appears to have entities in Cyprus and possibly the Bahamas, but not in Russia, and has very few, if any, employees based in the latter country.

What seems much more likely is that Apple has had lots of complaints about people being scammed by companies using MetaTrader platforms. If Apple receives enough complaints then they’ll ultimately take action against an app.

There were signs that this may have been on the cards. As written here a couple of months ago, MetaTrader had allegedly been making it much harder for white label providers to onboard clients. Just as there has been no publicly disclosed reason for the app removal, the company has purportedly never told clients why it started to do this.

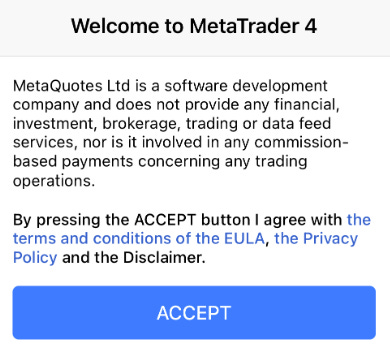

On top of this, traders using the platform have claimed that the company started putting in a new disclaimer, which had to be agreed to, when logging into either MT4 or MT5 about a year ago. You can see this below.

Then in June of this year, a local regulator in the US, the California Department of Financial Protection and Innovation (DFPI), issued a press release, noting that a California resident claimed to have been scammed by a woman from Hong Kong using MT5. A thread on Reddit with similar stories is wild.

A month after that, US Senator Sherrod Brown, Chairman of the Senate Committee on Banking, Housing, and Urban Affairs, sent letters to Apple and Google’s CEOs, asking how they ensure crypto trading apps on their respective app stores are not fraudulent.

Likely on the back of the press release accompanying those letters, Forbes published an article detailing the letters but also interviewed the man whose scam had been highlighted in the original DFPI press release.

The same journalist then did a more in-depth piece, which was published two weeks ago, explaining how the man was scammed. Significantly, the journalist reached out to Apple, whose spokesperson told him:

“[Apple] is investigating complaints about MetaTrader, and will take additional action to protect App Store users if necessary.”

All of this would suggest that MT4 and MT5 were removed from the app store because of complaints, although it does still need to be confirmed. Would anyone really be that surprised if that was the case though? The crazy thing is not that this happened but that it took so long to.

When I wrote about the white label problems here not too long ago, one of the points made was that MetaQuotes won’t onboard certain brokers but also won’t do anything to existing clients that fit the same profile.

A very simple example of this is faceless, offshore brokers going after customers in the US, of which there are many. Not only are the people running these companies suicidal – the US will get you – but it is not surprising that these sorts of behaviours would ultimately impact MetaQuotes.

Some companies appear to be trying to take advantage of the situation by offering alternative platforms or other workarounds.

But looking to the long-term, it will be interesting to see if a new pinch point, a la payments, is now in play for the sector. If the two big app stores start cracking down on apps then it’s going to make life a lot harder for companies in the CFD industry.

Up until now, the gatekeeper to the app store has effectively been MetaQuotes or your white label provider. If the gatekeeper becomes Google or Apple instead, they are likely to be much tougher on who gets in and who doesn’t. Fun times ahead.

Deriv is opening an office in Vanuatu

Something caught my eye last week, which is that it seems Deriv is now doing business in Vanuatu.

The Hong Kong-based group set up an entity in the island last month, with company founder Jean-Yves Sireau named as its director.

Vanuatu has become one of the ‘go-to’ destinations for brokers looking for an offshore licence over the past few years. Given that you aren’t required to even go there to get the licence, only need $50,000 in capital, and just have to employ a single person in the country, it’s not hard to see why.

However, according to Deriv’s website they are going there, not just for the licence, but to “[benefit] from the regional talent pool”.

This is a great point. Bustling financial centres and hubs of commercial activity, like Tonga, Tuvalu, and – who could forget? – Niue are simply bursting at the seams with prospective CFD broker employees. Just another great reason to get regulated there!