Get more clients and boost retention with ForexVPS.net

Crypto is the currency of the future and it always will be. And yet for some reason it just will not die.

At the end of 2022, I thought that rate hikes would in some way kill Tether, which would have a cascading effect on the rest of that market. That didn’t happen. In fact, Tether’s market cap has kept growing and now stands at $110bn.

Looking at Google Trends, we saw a big spike in the number of people searching for ‘trade crypto’ in the first quarter of the year.

You can see that playing out in some other ways. Anecdotally, two conversations I’ve had with major brokers led to them saying Q1 saw a good bump from more crypto trading.

“Things are picking up,” one executive at a crypto firm told TradeInformer. “You can see the money flowing into the industry. Tons of startups raising. Tons of new retail and institutional clients.”

If you look at XTB’s latest report, they say that two the most profitable CFD instruments traded during Q1 were BTC/USD and USD/JPY. The latter is probably a whole article in and of itself but the former suggests searches are translating into trading volume.

ATFX’s recent hires have over 100 years of industry experience. Read about it here.

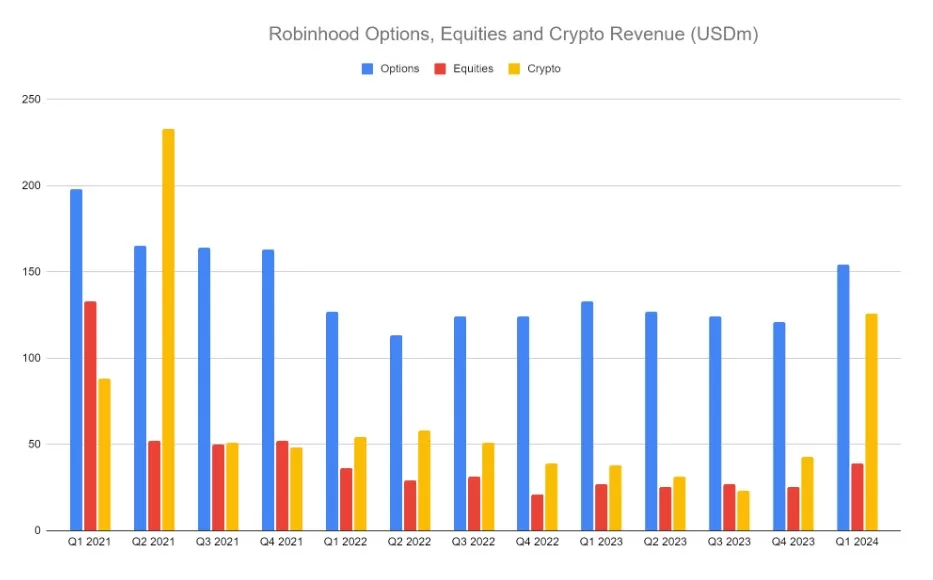

Over in the US, Robinhood released its Q1 results last week, which showed crypto trading revenue of $126m – the highest level since the meme stock boom of 2021.

We have looked a few times at the logic behind crypto, suffice it to say that TradeInformer is not a ‘crypto enthusiast’ publication.

The one argument which is somewhat convincing is that it provides an easy way for people in countries with sanctions and/or capital controls to access dollars. For example, based on SimilarWeb data, the top 5 countries visiting Binance are…

….you can see that every single one has capital controls and, in the case of Turkey and Argentina, insanely high inflation. There is some irony that the main use case for crypto may actually be accessing fiat currency.

But then does it matter if crypto works or not? From a broker’s point of view, it probably doesn’t.

A couple of weeks ago we looked at the synthetic indices that Deriv offers. These appear to be based on a random number generator that Deriv controls. So if we assume these are performing well, people are happy to punt on a random number that causes a chart to move up and down.

Crypto at least has some claim to validity, even if I think it’s misguided. This is…nothing? And so my point is not that there is something objectionable about this, but that if a broker is simply a neutral outlet, providing access to whatever people want to trade, logically they should add crypto.

Another factor goes back to what we saw last week, which was the fact that XTB has – it seems – managed to clip off a lot of CFD business by getting people to trade stocks.

Many eons ago, eToro CEO Yoni Assia told me that half of eToro clients trade one asset and then move on to another, so presumably that’s still happening there too. This has definitely been a benefit for them from a marketing point of view in the UK, partly because they are one of the only CFD providers to offer physical crypto but also due to the looser (no % loss risk warning) restrictions.

Given that the FCA are nerds and banned crypto CFDs in 2021, adding physical crypto as a broker in the UK probably makes sense.

Even XTX Markets, whose founder Alex Gerko is definitely not a fan of crypto, still makes a market in the asset class.

So I guess ultimately this is one of those things where you add it and potentially gain some benefit from it before it blows up. Or it doesn’t blow up and actually sticks around for a while. Win-win.