Turn your broker into a lead generation with cTrader

Not that long ago we looked at the idea that you can offer CFDs and call them perpetual futures because in many jurisdictions there is no legal definition of one or either products.

This would be a logical thing to do because crypto traders do not like CFDs but if you give them the same thing and call it a ‘perpetual’ they do.

Can you do the same with event contracts?

The short answer is ‘probably’. The rebranding part does not seem hard. You just take old school binary options and call them event contracts.

Only the real deal – get access to genuine Prime of Prime services with ATFX Connect

The hard part is the UX.

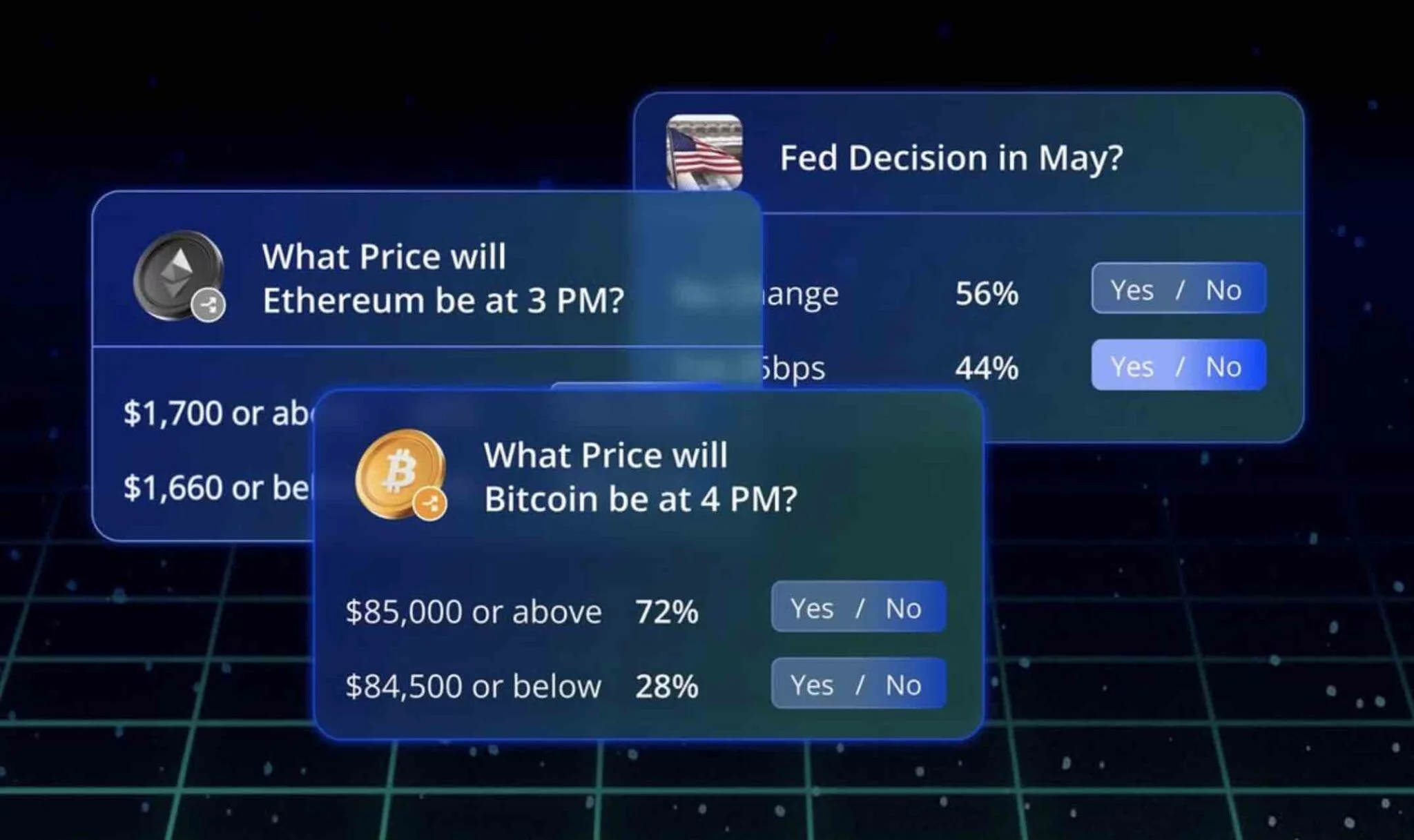

One of the main innovations of event contracts is to make binaries much more intuitive to understand. I pay X for a contract and my potential return is always $1 per contract, with the terms of the option phrased as a simple ‘yes’ or ‘no’ question with matching order types.

Binary white labels are not set up in this way. Devexperts launched a Polymarkets / Kalshi-style white label last week but that seems to be the only ‘legit’ one on the market at the moment.

Having said that, IQ Option owner Quadcode is now a shareholder in Polymarket. They sold their US-regulated exchange QCEX in exchange for cash and equity in the prediction market operator in July. Maybe that will mean they start being able to white label a Polymarket-style offering down the line. Let’s see what happens.

Get true Prime crypto access with Scope Prime today

The other part of the ‘offer old school binaries but call them event contracts’ is the legal set up. In markets like the UK or EU, you cannot offer binaries. But if you are set up in St Vincent and the Grenadines, the Seychelles, or Mauritius (among other places) you still can.

There are quite a few companies that do this already. For example, Olymptrade appears to have made in excess of $180m in revenue in 2024, with its ‘fixed time’ products seeming to be a mainstay of that business. Others like Exnova and Pocket Option do the same.

So the bottom line is that you could indeed go somewhere offshore, set up a company and offer event contracts. In fact, that is what Polymarket was doing prior to getting a CFTC license via its QCEX acquisition.

All the best brokers use Pelican for copy trading – so why aren’t you?

Is there any point in doing this though?

If you look at the US, part of the reason for event contracts doing so well is that they are federally regulated, whereas gambling is state-based. Consequently Robinhood can offer sports betting across the US but actual gambling companies cannot.

If you’re in the UK and many other countries, this is just not a ‘thing’. For example, I can go right now and very easily make fixed odds bets on sports matches and other ‘events’. I can also do accumulator bets, which you can’t do with event contracts.

Manage your broker’s risk with Centroid Solutions

To draw a comparison, IG pulled away from offering ‘real’ options in the UK after about 12 months. It’s plausible this was because options could cannibalise their OTC business.

Also likely is that there just isn’t that much point in having options because you can already trade speculatively with OTC products, including on options, so there wasn’t much demand for alternatives. Maybe the same thing would happen with event contracts.

The only reason I can see this wouldn’t happen is the branding point. Buying an event contract at $0.20 is no different to making a bet at 5/1. But like perpetual futures and CFDs, the buyers believe and feel like they’re doing something different, which is what matters.

Start hedging with Hantec Prime today

Whatever the case, in the UK I noticed that law firm Ashurst published an article this month on what constitutes an event contract and whether or not it’s a CFD, binary, or gambling bet.

The fact they published that article strongly suggests they have had questions about them, which would in turn mean there are companies looking at adding them in the UK. JB Mackenzie, who oversees international expansion at Robinhood, confirmed they were doing this in the UK and Europe in September.

If they are banned as binaries, what would be funny is if brokers just bring back sports spread betting. Although they now try to be highfalutin, it’s not that long ago you could ‘trade’ on cricket matches, the footie, and political events with companies like City Index and IG Group.

“We will bet on anything so long as it is in good taste,” David Buik of City Index told the Telegraph, back in 1999. “For example, not death; not the royal family.”

So maybe the solution is just a rebranding of what already exists. Time to bring back the political bets and sports betting, or start making a spread on how likely it is dildos are going to be thrown on to a basketball court? You could call them spreadiction markets.

Alternatively, and for the offshore binary people, you can just take a Quadcode old school binaries white label and call it ‘OTC Event Contracts’. Olymptrade used to call them ‘quicklers’, which is not bad.

You can make more money with those products too. And if all people care about is the brand, maybe that’s the right thing to do?