My only sojourn into Sub-Saharan African does not arouse fond memories. Over a month without meat. Constant nausea from malaria tablets. Hornbills smashing their beaks into my bedroom window every morning. Being called ‘faranji’ all the time.

And aside from having no running water, basic medical supplies or electricity, the thing that really struck me was how unfortunate the people there were in not being able to trade highly leveraged currency derivatives.

What a change a decade and one set of ESMA regulations can make. Today lots of brokers are active across Africa, albeit primarily in countries that are much wealthier than the one I visited.

Aside from regulatory changes, another factor that has driven this is smartphone usage. In Nigeria, the proportion of the population using a smartphone is thought to have almost quadrupled since 2014.

In South Africa the change has been similarly dramatic. One 2018 survey from Pew Research found that 51% of adults had a smartphone in the country. A follow up poll in 2021 undertaken by GeoPoll showed that number had increased to 91%. Along with more disposable income, this has made these people more suitable targets for brokers.

It’s been common for brokers to get licensing in South Africa for a long time now, but more recently we’ve seen companies, like Equiti and Scope Markets, getting regulated in Kenya. Others are staying offshore and working with IBs and affiliates on the ground.

As a simple way of seeing how effective they’ve been, you can look at some searches in Google trends. For people unfamiliar with this, it’s a free tool that gives you some idea as to how much people are searching for a given term. It also shows you where people are searching for that term the most.

Amazingly, if you look at a few basic forex search terms, the top five countries searching for them are all in Africa…

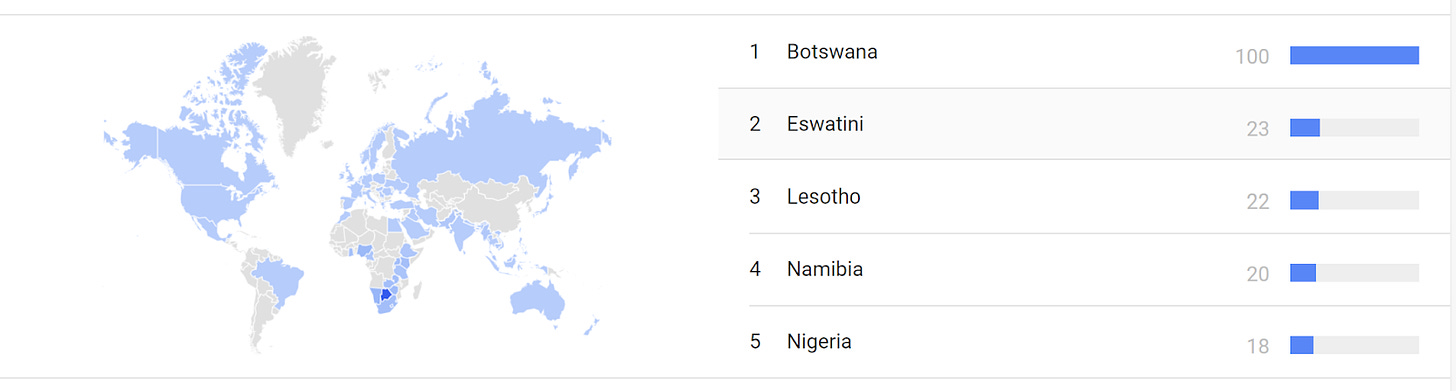

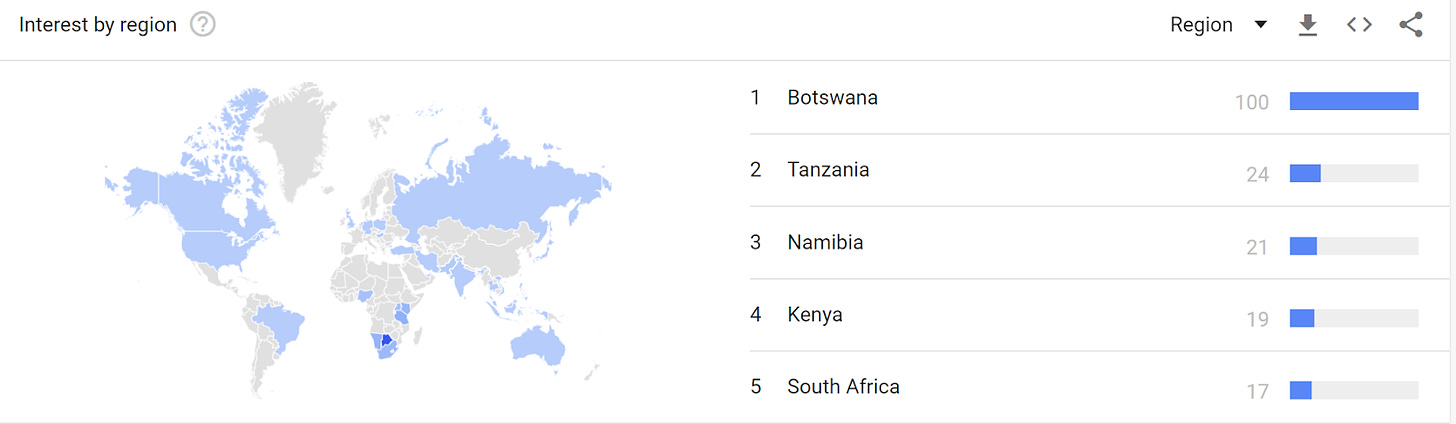

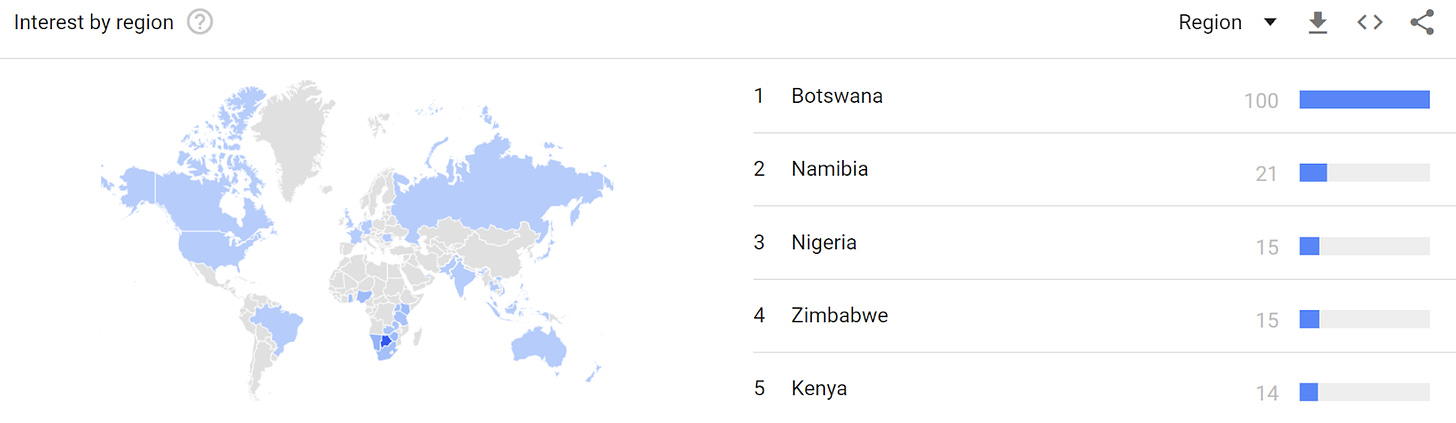

What is forex

Best forex brokers

How to trade forex

What does this suggest?

Well, either people in Africa have suddenly become very interested in trading the currency markets or they’re getting hit with lots of marketing to try and get them to trade. It seems more likely to be the latter.

As to why Botswana takes the top spot in all of them, I’d guess it’s because brokers are keen on the country as…

- It’s stable

- People are comparatively wealthy

Another simple way of looking at broker activity is to use SimilarWeb to see where traffic is coming from for their websites. SimilarWeb is often inaccurate on the specifics but does give a good general overview of where traffic is coming from. In other words, a broker may not be getting exactly 20.23% of their traffic from a given region but they’re still getting a decent chunk of their traffic from that region.

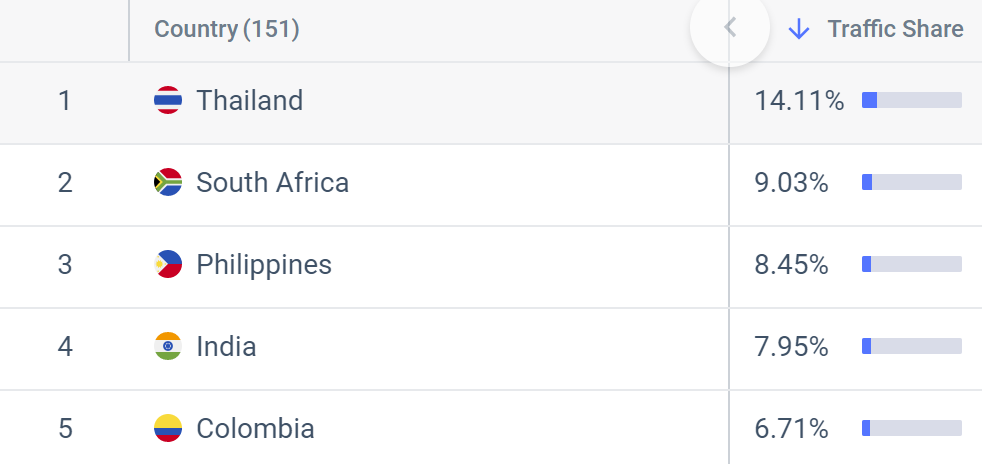

So if we look at XM…

We can see that 9% of their traffic is purportedly from South Africa and the country brings the second-highest number of site visitors.

Then we can look at Scope Markets…

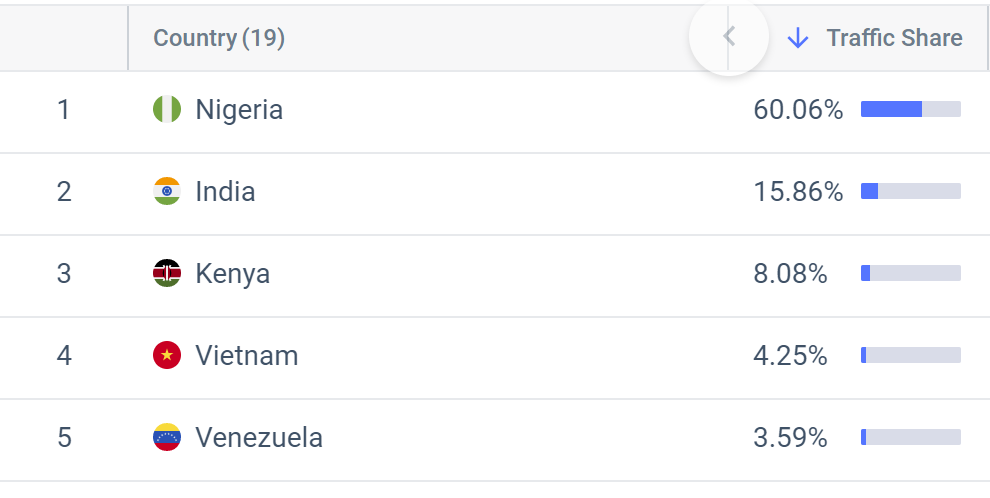

Here 60% of traffic is from Nigeria and another 8% is from Kenya, meaning at least two-thirds of site visitors, if SimilarWeb is accurate, were from two African countries.

Finally, you can see FXTM’s traffic below…

Egypt is usually bracketed into the MENA region but this would still mean four of the five countries that visit FXTM’s website the most are in Africa (again, assuming SimilarWeb is accurate).

I selected the above three at random but looking through a couple of other brokers, a common theme emerges, namely that a large number of companies in the CFD sector are now almost exclusively targeting emerging markets.

More specifically, they’re going after customers in Africa, LATAM and Southeast Asia. For example, if you look at where Exness does not take clients from, it boils down to the EU countries + UK, US, Canada, Australia and New Zealand. In emerging markets the restricted countries are mainly those where Exness is regulated or it has a local presence.

Doing business in Southeast Asia isn’t new but LATAM and Africa seem to have really come on to the radar more after ESMA’s restrictions in 2018. You have countries where people aren’t aware of the product and regulation is light.

There is also money to be made. It is hard to figure out exactly how much brokers are making from their activities in Africa. However, an interesting proxy to look at is gambling conglomerate Super Group, which owns brands like Betway.

The group has been expanding a lot in Africa over the past few years and in their most recent accounts note that…

- They expect African gambling revenues in Africa to rise from $1.5bn in 2021 to $4.1bn in 2026

- They derived 17% of their total revenue (€214.2m) in 2021 from African countries

- When they started meaningful marketing activity in one country in Africa (unnamed) in 2018, they were making over $2m per month in revenue within two years

Gambling almost certainly has a broader reach than CFD trading does. Nonetheless, it’s a sign that you can make money in these markets. That’s why so many brokers are doing it.