Get more clients and boost retention with ForexVPS.net

This industry is a lot like a conspiracy theory. The average person hasn’t heard of it and when you try explaining it to them they think you’re weird. Also once you see it, you can’t stop seeing it everywhere.

And to illustrate this, when I went to Tallinn last week, I got off the plane and was immediately greeted with this…

…then over the weekend in Poland, I was wandering through Warsaw and first stumbled upon a big group of Legia Warsaw fans with Plus500 plastered all over their shirts. And then walking around the centre, I looked up and the XTB logo was on a skyscraper. FML.

Anyway, XTB is a company that is doing very well at the moment but we didn’t look at it that much. And with the scent of Tyskie and the spirit of Sobieski wafting through the Warsaw air, I figured this is an opportune time to do so. Dawaj!

ATFX has big plans. Recent hires at the company – including FXCM Founder Drew Niv – have over 100 years of combined experience. Read all about it here.

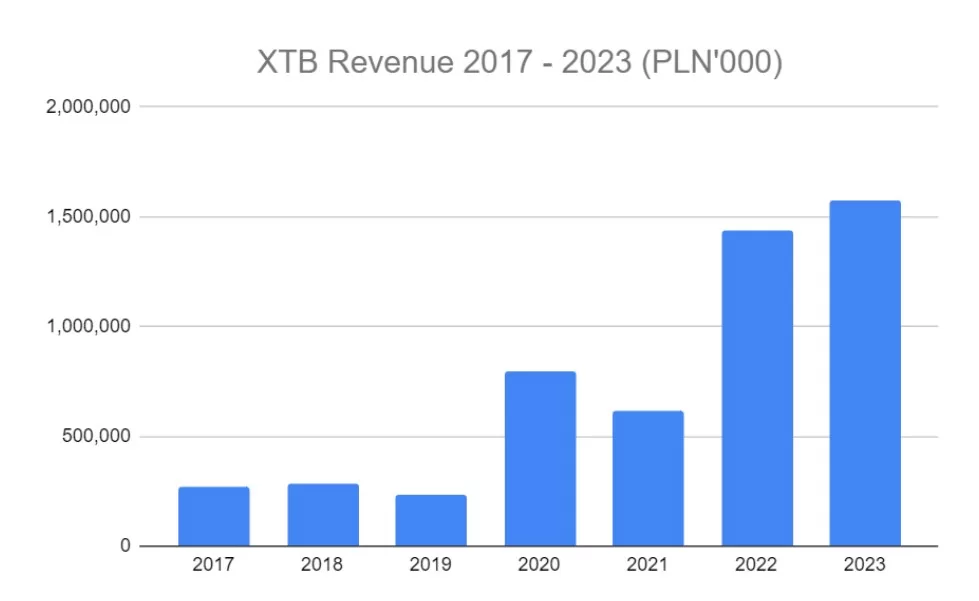

XTB has seen unreal revenue growth in the last few years. You can see this in the chart below…

Or to put that in more context, here is YoY % revenue growth for the other listed players. Note that CMC Markets and IG Group’s financial years differ from the calendar year, so this is not a like for like comparison. Even so…

All the players saw a decline from 2018 to 2019, probably because 2018 had that crypto rally / crash which was a one off event.

The more remarkable point here is that XTB revenues from 2021 to 2022 rose from PLN 618.45m ($154.51) to PLN 1.44bn ($360.02m). As you can see above, that was a 132.38% increase in revenues.

By comparison Plus500 and IG Group both delivered revenue growth of just under 16% and CMC Markets saw a nearly 30% decline in revenues over that period – again noting that this is not like for like given different time periods for IG and CMC.

This is one of those things where if the information was not public, you’d have nargila with someone at iFX Cyprus and go ‘yea, I don’t think that’s real’. And they’d say ‘bro, it’s real’.

And the reason for that is when you see growth like that it’s usually because of….

- Market volatility

In this instance there was nothing. You can see that all firms saw a slump in the beginning, probably because of the bump in revenues that the crypto crash produced in 2018. They also all saw a big uptick in revenues because of the pandemic. Nothing really happened that delivered similar growth levels in 2022. You could argue Q1 because of Russia invading Ukraine but then you’d expect to see that across the board which didn’t happen.

- Acquisitions

IG’s top line revenue growth is somewhat misleading in the graph above, given that it was partly fuelled by the tastytrade acquisition. But XTB – from what I can see – made no large scale acquisitions that generated revenue growth in 2022.

- Low base level

This is not the case as XTB was already making good money / very profitable by 2022.

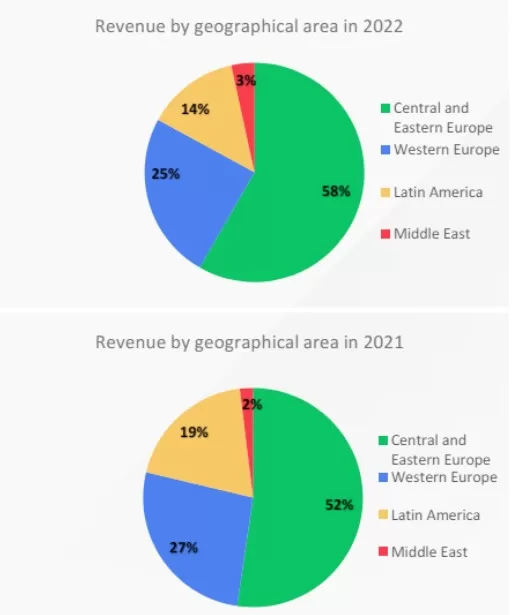

There are other potential options. For instance, XTB could have launched into new markets. But if you look at their annual report from 2022, core markets were where the biggest growth was in revenue terms.

This means

- There was no market volatility that caused a spike in earnings

- There were no takeovers that would have enhanced earnings artificially

- There was no low starting point that would make revenue growth easy

- There was no dramatic expansion into new markets

So what gives?

The first thing to note is that XTB does not seem to have been the only firm to have seen crazy growth in that time. If you look at Exness, for example, their monthly trading volume went up from ‘less’ than $700bn at the start of 2021 to almost $3trn in 2022. Now you could say, ‘yea but bro that’s not real’. Bro, I’m sorry to break it to you, but having been to the office, I can confirm that it is.

However, Exness is probably in a different position as they have expanded aggressively in a few emerging markets, which we can see XTB hasn’t done.

There are two other companies that have also seen strong growth though and which may provide some clues. One is Capital.com. At least in the UK, revenue almost doubled from £15.4m to £29.1m.

The other is Trading 212, which has seen crazy growth in the last few years. In 2016 Trading 212’s UK entity, which could still take German clients, made a little over £3m. In 2022 they made £114.9m and that was without being able to onboard clients for the first 8 months of the year.

Capital.com and Trading 212 may provide some indication as to how XTB was able to deliver such large scale growth.

One facet is that both are just good at onboarding clients. If you look at something as simple as the funnel from wanting to sign up to being on the trading platform, it is extremely smooth on both.

For Trading 212, growth has also clearly been driven by their adding of equities trading. Much as it pains me to say it given my former employer, I believe they were the first to launch commission-free equities in the UK.

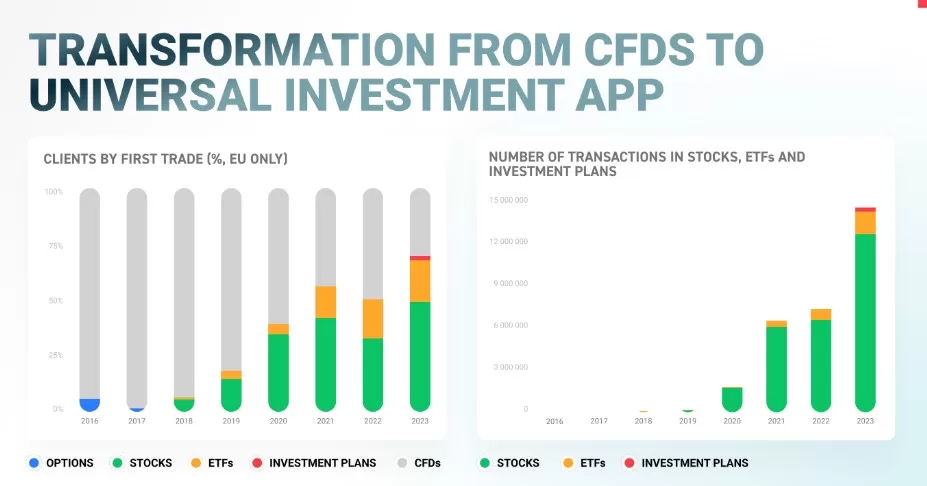

XTB has also launched equities trading and is planning on launching other products. And if you look at their most recent annual report, they included a slide on what people trade when they first sign up.

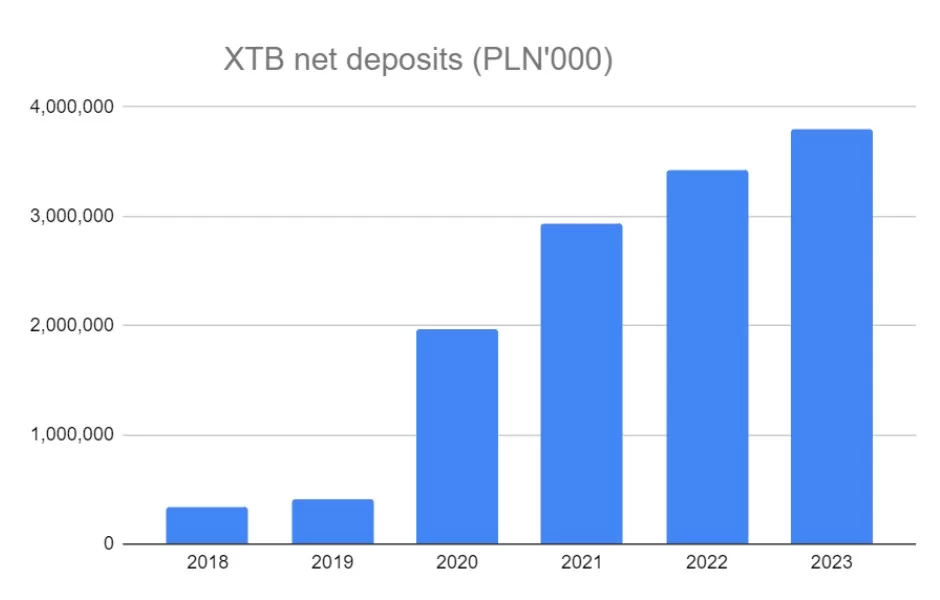

You can see this play out in another way in the company’s accounts, as client deposits rose massively at the same time, presumably because they were putting in more cash to invest rather than trade.

And indeed, in a recent interview with Polish outlet Rzeczpospolita (easy to pronounce for non-Polish readers), XTB’s CEO Omar Arnaout said…

“[We] see that clients who enter the stock market have some knowledge and are looking for volatility. The same applies to those whose first choice is cryptocurrency contracts. They follow volatility and can move markets depending on where that volatility occurs. At some stage, they also enter the CFD market.”

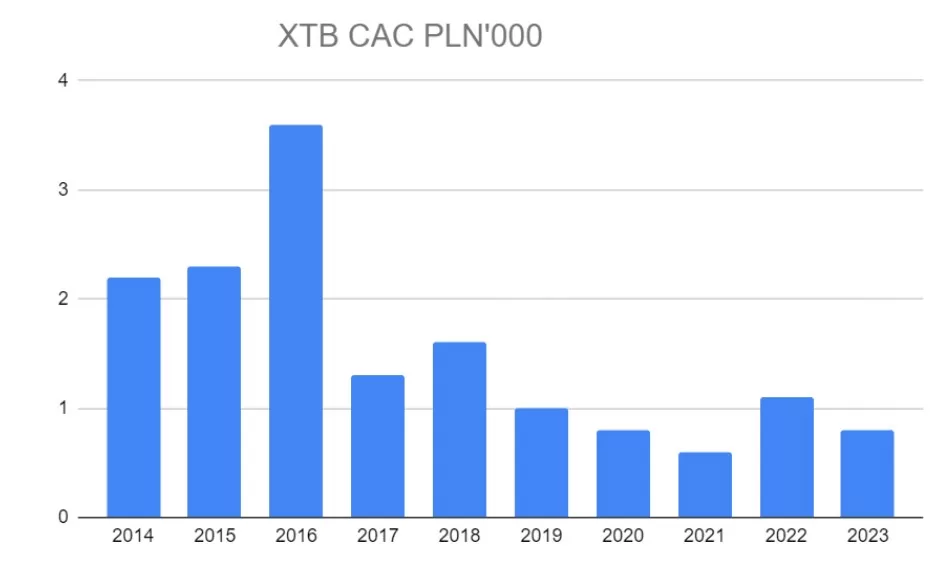

So clearly this is one facet of it. What is also probably true is that the markets XTB is focused on (Poland, Spain, Czech Republic) have lower average customer acquisition costs (CACs) for stock trading. CACs for stocks in general are lower but it’s plausible they are even lower than you’d expect if these markets have not been targeted as much with that product.

And indeed, if you look at the above, you can see CACs did come down after stock trading was introduced in 2018. What’s also interesting here is that you can see the increase in 2022 is mirrored by a drop in the number of people whose first trade was a stock trade in the same year relative to 2021.

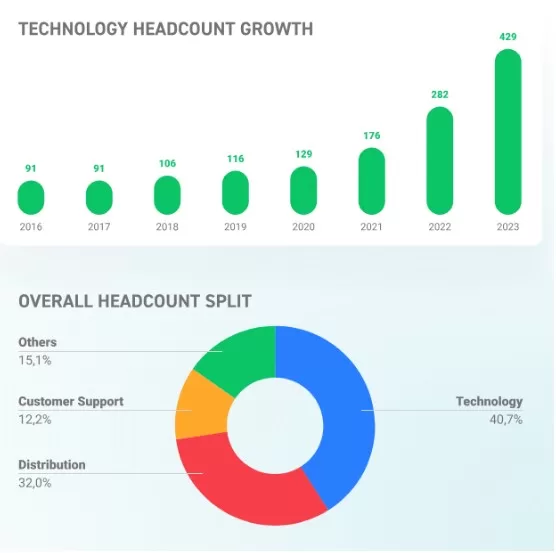

The only caveat I’d add to this is that there are natural tailwinds. The pandemic, for example, was a ‘rising tide lifts all ships’ type of environment. Also XTB has invested a huge amount in tech development. You can see this below…

I am often sceptical of claims that hiring more developers leads automatically to greater output. Ie. hiring one more engineer does not lead to an automatic X% increase in productivity. However, I thought they’d fire a lot of these people last year and didn’t do it – the fact they kept revenues at a stable tells you why and also suggests something is working.

And that points to the final possibility, which is that XTB is simply enjoying the benefits of scale. As you grow, you have more money to dump into marketing, which is also (hopefully) more efficient due to better technology. As long as your input (ie. CAC) remains within a decent range, and you don’t see a flatlining effect (ie. you are putting in more and more cash without the commensurate output) then you can just keep printing money.

Sometimes when I look at marketing stuff I want to find some kind of amazing ninja technique that a broker has discovered and is using to make lots of money.

This can make you forget that in this industry, you basically make money by…

- Onboarding new clients and getting them to trade

- Getting existing clients to trade more

- Capturing as much P&L as possible from this activity

Somehow XTB is very good at this. Whether it’s technology, getting cheaper CACs with new products, or something else, they are doing it.