DXtrade lets clients trade with you via TradingView. Click here to learn more about the integration and how you can access over 50m traders in 200+ countries.

Readers of the inchoate TradeInformer WhatsApp Channel will have seen a brief analysis of India at the end of last week.

This is a market that we haven’t really covered before but is increasingly being targeted by brokers throughout the industry.

The main reason for its growth is kind of similar to other parts of the world, where over the past decade you have seen…

- More people with IDs so they can pass KYC

- More people with access to digital payments, so they can make a deposit with your company

- More people with access to mobile phones, so they can download your app

Two apps that are now harder to download in India are MT4 and MT5, which have been taken off the Play Store in the country.

According to Statista, about 95% of Indians use Android devices, so unless there is a large skew to iOS among traders, this presumably means the two apps are inaccessible for the large majority of Indian clients, bar a direct apk download.

What’s interesting about this is that it is typically developers who restrict access to a given country, rather than a total ban or removal, which usually comes from either Apple or Google, depending on the relevant app store.

There is no information as to why this happened but given the country’s central bank has issued several warnings over the past year about unregulated ‘forex’ brokers, it’s plausible it is due to some sort of regulatory or political pressure.

One thing I wonder about here is if brokers actually hurt themselves by continually (and infuriatingly) calling themselves ‘forex’ brokers, when they aren’t actually offering money broking services.

The reason I say this is that many emerging market countries hate unconstrained foreign exchange flows. Like other EMs, India has had a long history of running large fiscal / current account deficits.

So every time oil went up, or the US dollar went up, or the US dollar and oil went up, India would get wrecked and have to ratchet up rates + see growth stall. Even though they have now, like many other Asian countries, amassed huge foreign reserves, they still have fairly strict capital controls because of this.

Now imagine you are a regulator who has this mindset. Then you have a bunch of people spamming your citizens with massive marketing campaigns, all claiming to be forex brokers. It is hard to imagine authorities in any of these countries being happy about it.

App store bottlenecks

Whatever the reason behind the removal, it follows some other events that we’ve covered here recently.

The problem for MetaQuotes seems to be that the two app stores are a bottleneck that can’t be removed.

Basically as long as the potential to get taken off the app store is there, then it will continue to hang like Damocles Sword over them and, consequently, their clients.

One of the other topics we’ve looked at before is how payments companies and Google / Facebook have emerged as quasi regulators. Payments companies will block your company from taking deposits and Google / Facebook will block you from advertising.

A lot of the time there is a lack of consistency in these policies.

To give an example of this, I have spoken to FCA-regulated brokers who will get blocked by Google. But then I regularly see ads on Google platforms from unregulated brokers in St Vincent. What can you do?

Are props breaking trade reporting rules?

The way that a lot of the new so-called prop firms work is that the customer takes a challenge trading on a demo account. If they pass that challenge, they are then given a ‘real money’ account to trade with.

Listening to different people explain how the real money component of this is actually structured is like listening, as one reader noted, to Kramer talking about write offs. No doubt we will see more of these guys blow up in the next couple of years.

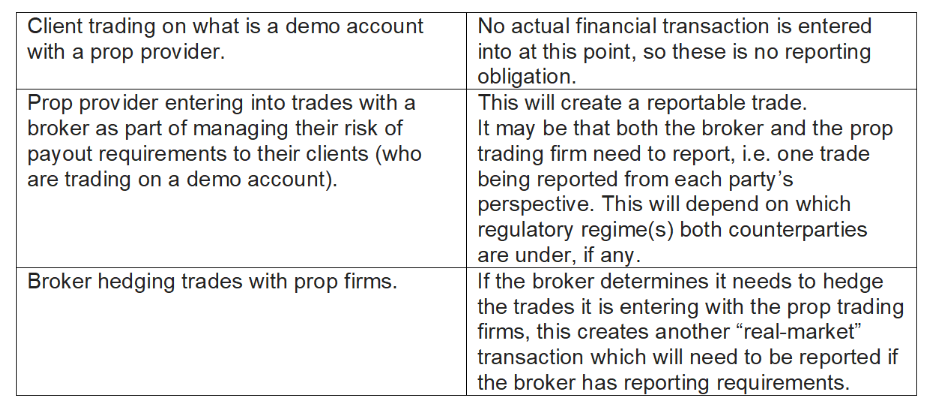

Whatever the case, some providers should – in theory – be trading in the real world at some point. The question then is should they report trades under regulations like EMIR?

“Based on the way prop trading has been described in court cases and the media, in most cases, a reportable trade will be created in one, if not two parts of the lifecycle,” said Quinn Perrott, Co-CEO of trade reporting firm TRAction Fintech.

There are a few ways that trades appear to be structured. From what I can tell, these are broadly…

- Mirrored trades via a retail broker account

This model is presumably becoming less popular as brokers stop providing grey labels to props. But in effect this would entail a prop having its own account with a broker. Any client trades would be mirrored from demo accounts with the broker. My guess is that the broker would handle trade reporting in this instance.

- The ‘definitely not b-booking you’ model

Probably the most questionable model I have seen, which is what My Forex Funds was offering, is when a pop firm has its own server with MetaQuotes or some other trading platform. Clients are then given money to trade with. They then trade…against the prop? This would create a reportable trade for the prop and then another reportable trade if they were hedging out.

- The mirror trade on own account model

This is similar to the first option, except in this instance the company has its own trading platform / MTQ license. Basically clients place demo trades and then the prop places matching trades in its own account.

If you assume that the prop is (1) doing this as a legal entity and (2) based in Europe, then they would have to report them. Again, this would depend on whether or not the broker they are trading with would manage the reporting requirements for them.

- The trade on corporate account model

Some props purport to allow clients to trade a real money account on some sort of corporate account. Again, this would create a reportable trade assuming the account belongs to a legal entity and if the broker the client is trading with is not already reporting for the prop.

Looking at how many props are operating, it would not surprise me if at least one of them is breaking the regulations here, but isn’t even aware that they’re doing it.

Changes to demo accounts on MT4

One other interesting change which took place last week was on MT4. The settings for the platform were altered such that you can set up a demo account but you can only make an ‘initial deposit’ with it. No other alterations or ‘deposits’ can be made after that.

Again the goal here appears to be to squeeze prop firms. As we noted a couple of weeks ago, this is not unreasonable from MetaQuotes’ point of view. They make no money off of these companies, but are subject to any fallout from the huge risks they are taking.

Startrader trying to launch in Europe

Dubai-based broker Startrader released an ‘annual report’ last week, with CEO Peter Karsten running through some of the company’s key results.

Two points stood out though, one was that the company has been active in Saudi Arabia. We’ve seen signs that brokers are going after this market but this was more direct confirmation that it’s happening.

The other notable point Karsten made was that the company is trying to expand into Europe and is in talks to acquire an EU-regulated business, which presumably means Cyprus. So I guess Europe isn’t dead?

Louay Amhaz launches liquidity provider

This is old news but, hey, no one reported it yet.

TradeInformer understands that Louay Amhaz, formerly Director of Business Development at oneZero, has launched a new liquidity provider. The firm, which is called LP Prime, is regulated in South Africa.

Amhaz is joined at the firm by Alex Kukhtikov, who worked at B2Broker for over seven years prior to making the leap earlier this year.