We have a new podcast out.

This time around I’m joined by Quinn Perrott. Quinn is the Co-CEO of regulatory reporting tech firm TRAction Fintech. He was also one of the founders of Axi, an Australian broker.

We talk about regulatory changes and what they mean for the industry, Google acting as regulator, new products, and what the outlook is for the industry.

Listen via any of the links below

They’re coming to America…

Earlier this year we spoke to eToro UK MD Dan Moczulski, who made the point that in the early 2000s, he was on the sales desk at IG and couldn’t believe they were getting 400 accounts a month. At the time it seemed like that was the industry ‘peak’, even though today there are brokers that would be unhappy with 400 account openings per day.

I thought about this while looking through IG Group’s annual results, which were published earlier this month, but in a slightly different context. The point Dan was making was that it was that, without the benefit of hindsight, it was hard to believe the industry could get bigger than those 400 accounts per month. For me, the question is whether IG could actually end up being a US company in the next decade or so.

This would have seemed weird a couple of years ago, given less than 5% of IG’s revenues were derived from the US. But if you look at the company’s latest results, which were released earlier this month, US sales (£191.3m) now comprise just under a fifth of total revenue (£1.02bn). The majority of that is from tastytrade, although IG’s FX offering there also delivered £20.5m in revenue last year.

IG continues to tout tastytrade as their primary driver of growth. In the presentation that accompanied the annual results, the company said they expect medium-term revenue growth in tasty’s revenue of 25% – 30% on an annual basis.

If we assume that holds, which it has done since they acquired the company in 2021, then you can see how US revenue would continue to grow as a proportion of the total. For example, 25% CAGR on current tastytrade revenues would mean that part of the business is making £332m in three year’s time.

You can also see why there is reason to be optimistic about this growth. Beyond the obvious point that the US is the world’s largest economy and has a large number of active traders, if you look at Charles Schwab’s (CS) results from last year, they made close to $1.2bn from selling options flow alone. Annoyingly CS does not break down commissions by product, but total commissions, across equities and options, were $1.7bn.

CS revenue from options seems to have been heavily driven by their acquisition of TD Ameritrade. But TD Ameritrade itself entered the options game properly by acquiring thinkorswim, a derivatives broker that was founded by the same people that ended up founding…tastytrade.

This is not a guarantee of success but I guess the point here is that (i) the tastytrade people have a good track record and (ii) there is a large market in the US for the product they’re offering.

If they are able to capture a decent proportion of that market then, if you think long-term, it’s plausible that a decade or more from now, IG will see most of its revenue derived from the US. When they bought tastytrade, this author thought IG got bumped – but maybe it will prove to be a great deal long term.

Whether or not that happens, options are shaping up to be a good product for IG. Revenue per customer last year was £1,426 – so not CFD levels but wayyyy above what you make from equities trading and definitely enough to make a good company.

Having said all of this, there were still some interesting areas in IG’s report that show other areas of growth. One was Spectrum, which targets European clients for trading turbos and similar contracts. Revenue per customer here was £2,286, which is way up from £913 in 2021 and substantially ahead of 2022’s figure of £1,367.

This part of the business is interesting because it seems much harder for peers to replicate. For instance, just creating the exchange facility needed for trading them requires a lot of investment.

As a result it’s also plausible that it will be less likely to get hit by regulators. If lots of brokers cannot start offering them, there are probably going to be fewer regulatory problems. At the same time, these seem to have a strange ‘respectability’ in parts of Europe. For instance, Societe Generale is a product issuer on Spectrum.

Spectrum revenues are still – at £15.7m – only a small proportion of total revenues but that is from a base of zero starting less than four years ago.

For more CFD-focused people there were also a couple of interesting points. One was that non-EU EMEA average revenue per client – at £6,961 – was the highest regional average. Presumably this is largely a reflection of clients in Dubai. Below that was Singapore at £6,058.

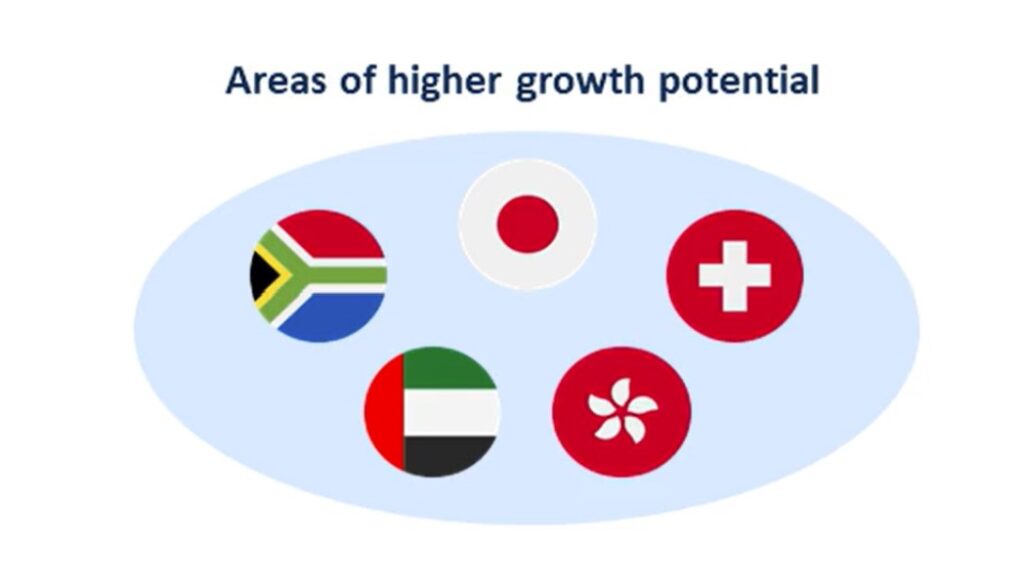

IG also included a slide where they noted regions with stronger growth potential for their CFD business. You can see these below.

Narks may note that the Hong Kong flag is there, a region where CFDs are banned. Go figure.

More retail on analyst calls

Retail investors at AGMs are usually easy to spot. Dishevelled clothing. Plastic bags. Swiping as many of the sandwiches and other complimentary refreshments as possible. You wonder if they’ve wandered in off the street. Then you speak with them and they turn out to have a few mil in their Hargreaves Lansdown account.

Many of these people continue to show up for the free sandwiches. However, their need to do so has diminished due to the increasing number of apps that let you ask questions to executives virtually.

This came to me when reading through Robinhood’s results a couple of weeks ago and I was thinking, ‘these are strange questions for analysts to ask’ – and then you realise it’s actually random shareholders off the internet.

Initially I thought this was a bad idea. Now I think maybe it’s a good one. Why?

From a purely selfish point of view, customers tend to ask a lot more about the product than the actual business. This makes it easier to come up with BREAKING headlines when writing CFDs Weekly.

It also makes for more interesting reading than dork analyst questions, which tend to be along the lines of ‘hey bro, can you please tell me if there is going to be a 0.01bps change in your broker margin so that I can make a tiny adjustment to my DCF model to shill your stock to our clients?’

However, for companies there is an added benefit. Your time on the call is limited. Retail clients ask softball questions AND you can presumably sort out the ones that would be ‘difficult’ to answer.

The result is that if you are a company looking to avoid answering hard analyst questions, you can get retail on, get loads of easy questions, take up all the time by answering them (or bore others off the call) and then put on a ‘man of the people’ kind of act by saying you look out for smaller shareholders. They aren’t called Robinhood for nothing my friends!