Earlier this year CMC Markets launched its new investment offering for the UK, CMC Invest. Although it’s far from the first player in the CFD space to expand into cash equities, CMC has had something of a different take, primarily because of the degree to which it has separated its new business from its existing one. There has even been talk of the CMC group splitting into two, with the stockbroking side of the company becoming a standalone business.

To get some idea of what the team at CMC Invest have been up to, I spoke to Albert Soleiman, the Head of CMC Invest UK.

Why did CMC launch share trading in the UK?

We are passionate about our mission to help customers reach financial security and investing is a great way to achieve this in the long term. What we see with the CMC Invest app, is a real opportunity to provide customers with the tools and guidance to help them make confident investment decisions. The share market can be daunting for many people, and we aim to demystify it for customers – making it a more personal and seamless journey. From a company perspective, the wealth industry is a major strategic opportunity and accelerates the diversification of CMC Group beyond the leveraged market.

It seems like a lot of new tech was built to get this up and running. Given you already have an entity offering share dealing in Australia, why was this the case? Are UK and Oz share dealing not connected?

Having an established investment platform in Australia has been a big asset for us and we relied on their expertise throughout the build project. However, the UK market is different from Australia both in terms of the investment products and tax wrappers here in the UK, e.g., ISAs and SIPPs. Therefore, a new platform and user interface was necessary to allow us to offer a platform tailored to the UK market.

Working at a share dealing platform for a couple of years, it really struck me how what were ultimately ‘small’ features in the app (eg. adding different currencies, analytics, new securities) were extremely labour intensive. Was there anything you found like that when building the app – things that you thought would be straightforward but ended up taking a long time?

We operate a subscription-based model – which is great from being able to tailor and flex to the needs of our customers in terms of build – but it’s complex because you have so many interdependencies. Then there are complicated processes that as you say on the face of it seem very straight forward but technically are quite difficult to implement – an example of this is making sure client deposits go to the correct investment account i.e. GIA or ISA. Our team is doing a great job at navigating any challenges.

What’s it been like launching at the moment? 18 months ago we saw this huge boom in retail activity, now it’s a lot more subdued and the macro environment looks really tough. Has that made things difficult?

The boom in retail activity was a great opportunity for people to become aware of investing and its benefits. Whilst there are some near term headwinds, we believe some of these trends and the power of the retail investor will endure. There’s a gap, however, between financial literacy and structuring an investment portfolio to work for you. We are extremely excited and motivated to work on filling in that gap for our customers.

Of course, there are challenges to launch in the middle of a bear market, but we are committed to long-term investing and bringing customers on that journey. We are here to help them navigate the short-term turbulence and focus on the long-term performance of equities.

As a company, the CMC Group has been around for decades, and we’ve seen all sorts of market challenges – from the dot-com bubble to the global finance crisis and of course COVID-19. Each of those situations had another side to it and stocks rebounded. Now we have the cost-of-living crisis and that is very difficult, but we are with investors for the long-term.

A lot of CFD providers have launched a share trading service but it seems mainly designed to cross sell other products. Is that on the cards for CMC? Assuming it’s not, what’s the ultimate goal? I’d also be interested to know if you have any thoughts on CMC Invest separating from the main business – for instance, if that happens, would it include the Oz business as well? What is the thought process behind that?

When we set out to build our investment platform, we wanted to really shake up the wealth industry and offer a product tailored to the modern needs of investors. CMC Invest provides a great user experience and competitive pricing. We have a heritage you can trust; we are not debt funded and we are very financially secure.

From the outset we focused on the customer and understood early on that through CMC Invest we’re addressing a different need. We’ve relied on everything that is great about CMC from our technology, execution, and industry knowledge. But we’ve built a standalone business, with its own regulatory licence and recruited a team of the very best experts from the investment industry.

I always called it a hard pivot. CFDs are a great product within the right investment strategy but our focus at CMC Invest is on an investor’s long term financial goals – not short-term trading and speculation which is well served by our sister companies. This is the right strategy for us and our customers.

Our goal is to become the UK’s investment platform of choice. That sounds ambitious given the incumbents, but we believe our vision for helping clients achieve their financial security and guiding them through their entire investment journey, will stand out and appeal to our customers.

With regards to any plans on structure, that is not something I could comment on at this stage. We are still very much in early days and although the team has delivered a huge amount in the past 18 months, our focus is on our customers and continuing to deliver for them.

The UK share dealing platform market is now heavily saturated and it seems plausible some firms may struggle in the next 24 months, as there is a push for profitability. On the back of that, would you consider acquisitions in the UK to get client books (as was done in Oz) and can you explain the business model for CMC Invest? From what I can tell it’s just zero fees with some charges for FX. How is this going to be profitable in the long-run?

On the first point, as I mentioned earlier, our focus at CMC Invest, is to deliver on our mission and for our customers. Acquisitions is not a priority at the moment.

In terms of our revenue model, our goal is to be simple, transparent and provide great value. Equally as important is sustainability. We want to be accessible to investors with varying portfolios – appealing to those who are starting out, as well as those with a wealth of experience. We make money from FX and custody fees (once we introduce additional tiers through a subscription model), so there is a transactional element to our model for foreign shares and a reoccurring income stream from the monthly charges. We see commissions as a barrier for smaller size trades, therefore we’ve eliminated them from the investment decision process. We achieve very low trading fees using the Group’s existing partners and brokers and we are able to pass these on to our customers.

Our business model is based on scale, and we will achieve profitability once we reach that. We have a lot to leverage off from the existing business and the scale we have there. From transactional fees to better pricing on things we purchase, whilst we are a start-up in many ways, we are standing on some very broad shoulders.

If you look at share dealing platforms in the UK, it seems like there is a rush to the bottom on fees. Do you think that’s a fair point? If so, what do you think is going to happen to the industry? Are margins just going to come down?

Investors want a credible provider who is going to be around and protect their assets. Being profitable is a key part of that especially in a raising rate environment where money is no longer free. They should be analysing and questioning their providers. Questions like – if you are giving me things for free, how are you making money? These are important. Our aim is to be transparent with everything we do. Fees and charges are very important to explain in the context of how the business will make money. These are all clearly explained on our website.

What has initial uptake of the product been like? Have you seen clients that use CMC for derivatives move their share trading accounts over for example?

We’ve been very pleased with the take up so far and especially encouraged by the take up from our existing CFD clients. We have some exciting releases with ISAs and multicurrency accounts coming shortly and we hope these will attract even more customers.

Finally, UK share dealing is probably more competitive today than it has ever been. How do you gain traction and beat the competition in this environment?

Stay true to our mission and values, and not lose sight of it. Continue to offer value and earn the trust of our customers. Understand that value is not just about being the cheapest but our overall proposition, service and the security we can provide users. Ultimately, it is about meeting client needs and understanding that our client relationships are the same as our view on investing – build for the long term.

A trip down memory lane

Last weekend I ended up going to the British Library to see an exhibition on Alexander the Great. I know some of you may not be familiar with this concept, so to explain, a library is a place where they keep books.

One of the services that the British Library has is the ability to search through a large database of newspapers, going back to the 1700s. And because I think about this newsletter way too much, I decided to see what retro articles the service could rustle up on the FX/CFD world.

There were some great finds. For instance, below you can see what may be the first article printed on the industry from October 1964. There seems to be a common misconception that IG was the first spread betting company. It was actually a firm called Coral Index, owned by the bookmaking group Coral, which is itself owned by Entain today. Incidentally, Coral Index is also where City Index founders Chris Hales and Jonathan Sparke started out. You can see an article announcing the company’s launch below.

A few years later, we have Coral’s launch of spread betting on the Dow Jones in 1967. As you can see, a positive benefit of spread betting is that you only pay sixpence on the pound for any gains you make, as opposed to capital gains tax which is err…8 shillings and thrupenny? Maybe older readers can let us know if that’s a good deal. You also have a snippet from an article questioning whether the wives of MPs have been breaking foreign currency control laws – “There seem to be so many of them going abroad” says MP Kenneth Lewis.

Next we have coverage of IG Index’s early days in a 1977 copy of the Birmingham Post. The spread (“jobber’s turn”) has undergone cuts and holding period limitations have been increased. As you can see, IG’s early appeal was that you could take a position on gold when Brits were prohibited from holding the metal in its physical form.

And in the same article, we see how IG lets you take a position on commodities with only a small up front amount of cash. There is also some sensible advice, noting that if you don’t put your life savings with them, IG’s services have much to offer.

Moving ahead into the wayfarer wearing decade that was the 1980s, we have a small note from City Index in the wake of the Black Monday crash of ‘87. Apparently punters were giving them cars in lieu of cash payments to cover their debts and they were running out of parking space. Note that this also implies taking on US clients – can you imagine it?

And from a year later, we have City Index founder Chris Hales making a comment about the crash at the launch of the company’s Dublin office. Readers may find some striking parallels with today.

Fast forward another decade and we learn from Herts News that Currency Management Corporation has moved to a 17th century building in Hertford. Company founder Peter Cruddas notes that most of their business is online, meaning there isn’t much need to pay the expensive rents in the City of London.

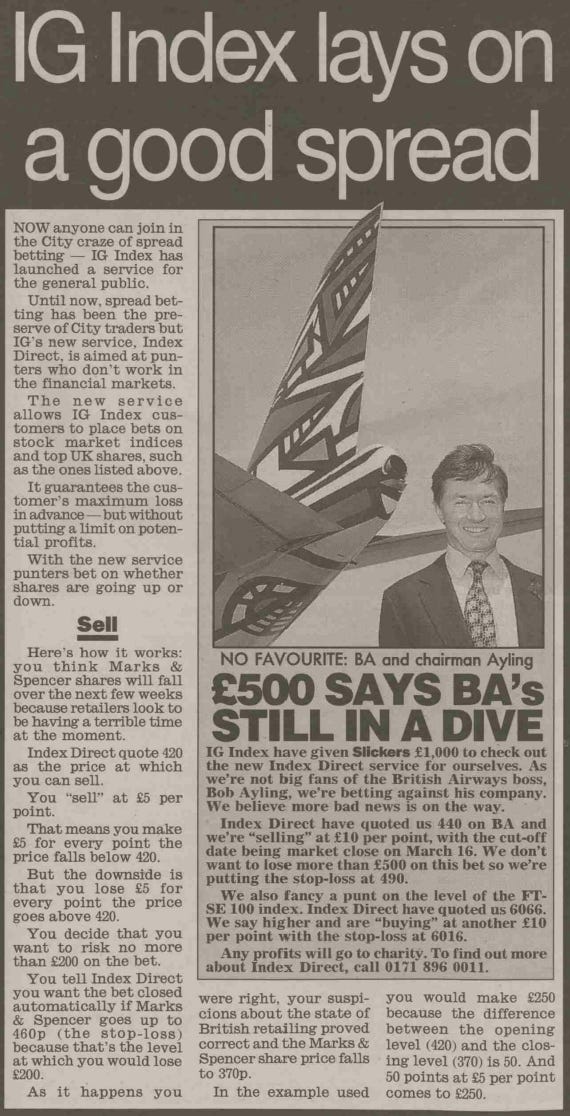

And to finish off we have a 1999 article (or ad?) from IG Index, courtesy of the soon-to-be -convicted-for-insider-trading ‘City Slickers’ – Anil Bhoyrul and James Hipwell, then writing for Piers Morgan’s Mirror. Will you take a punt with Index Direct?