Get more clients and boost retention with ForexVPS.net

If you live in the UK then one of the things you may have noticed recently is that the country is a total dump and nothing works. It’s like being in an emerging market, only without the balmy weather, spicy cuisine and the ability to smooth out interactions with public officials using bakshish. London is at the epicentre and increasingly resembles the Cantina from Star Wars, except with worse music, higher prices, and unfriendlier people.

These problems aside, the UK does remain the largest market for CFDs globally. The FCA is also still seen as the ‘gold’ standard regulator. It is thus unsurprising that people still want to do business here. But is it worth it?

The UK is a highly saturated market and is dominated by a few major players. By one account, IG Group controls more than 50% of the industry. If you are based here then you will see that pretty regularly when you Google anything trading or finance related. Some firms, SpreadCo comes to mind, appear to have carved out a small niche and make decent money, but not a crazy amount.

That being the case, it’s probably not surprising that there have been almost no new companies that have set up here and started making serious money recently. Although some older firms – eToro or Trading 212 – may have seen strong growth in the last five years, Capital.com is probably the only one that has entered the market in the last few years and made headway in taking market share and generating serious money.

Compounding this is the fact the regulator does not seem to like the industry much either. My understanding is no new licenses have been issued for over a year and several applications have been rejected.

Regulatory costs are also very high, which then serves bigger players, who can afford to pay up. This process is getting worse as ‘consumer duty’ regulations came into play recently. These seem to fit with a wider trend stemming from a pro-labour (as in workers, not the political party), risk averse culture. CFDs are more of a ‘buyer beware’ kind of product that don’t fit with this mentality. But that’s a topic for another article and a different website.

Keeping all that in mind, is it still worth trying to get a license here and how much would it actually cost? We’ve kind of looked at this before and reached the conclusion that sponsoring an English football team would probably be a better use of marketing spend than actually setting up shop here. But let’s say you went for it, how would it work?

At first I thought I’d write up some excel spreadsheet-derived internal rate of return for this. But actually it seems simpler to take a napkin and draw up some random numbers to see if you could recoup your upfront and ongoing costs in one year.

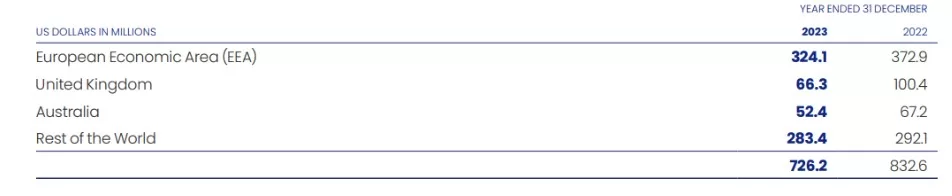

If we look at Plus500’s latest accounts, you can see that last year the company made $66.3m (£52.5m) in the UK…

For the company as a whole, the average cost of acquiring a customer – calculated by taking the number of new customers and dividing it by marketing expenses – was $1,489 (£1,1178). The average revenue per user was $3,116 (£2,466).

Looking at the breakdown of revenue attribution, 12% of sales were derived from clients that had been with the company for under a year. Assuming that applies to the UK, it would mean new clients joining the company generated £6.3m in revenue over the course of a year.

So then how much does it cost to get set up in the UK? From speaking to a few people in the licensing / consulting game, the figures seem to range from ‘it’s impossible’ to somewhere in the £1.5m – £2m ballpark. That figure is inclusive of your minimum capital requirement, which is £750k (note that matched-principal licenses are being phased out so this is not an option).

You then have to add on margin costs for LPs and your staffing costs. These are harder to predict and although some firms have administrative costs that are under £500k, I can’t see any with market making permissions. For those that do have market making permissions, even paying under £1m annually seems like a stretch. The absolute minimum figure one reader gave was £75k monthly, inclusive of office space etc.

So let’s say that your initial cost to get a license and open accounts with LPs is a total of £2m, with £750k as minimum capital requirement and £250k as margin. This means £1m is not ‘gone’ but you can’t do anything with that cash. Then you have ongoing monthly costs of £75k, not including marketing spend.

To keep things simple that means

Up front cost = £2m (£1m retained as margin / capital requirement)

Annual admin costs = £900k (75k*12)

Now if we go back to Plus500 as an example, let’s be real, you aren’t as good as them. Also a lot of their revenue is probably lopsided to people that have been with them for a while.

So instead of you making £2,466 per user, you are making £2,000 per user (I’m still being generous) and it’s costing you £1,400 to get that person. Your margin is £600 or 30%.

At £75,000 a month, you are going to have to spend an additional £175,000 to reach break even point on admin costs. Annually that is £2.1m. But then you are in the CFD industry and you like things done quickly, which means you want to recoup the entire £1m initial outlay you spent on getting licensed within the first year. In other words…

Admin costs + initial investment = £1.9m

To cover that you would need marketing spend of £4,433,800

So your total spend for getting the license + recouping costs and staying flat in one year is £6,333,800. Add in the margin requirements and minimum capital requirement and it’s £7,333,800.

But as the economist Thomas Sowell is fond of saying, we are dealing here with flesh and blood people. And in this instance, to achieve that figure, working with the margin described above, you would have to onboard 3,167 people.

Looks easy enough to be honest. Why aren’t you doing it?