This month’s edition of the C-Suite is brought you by InvestingReviews.co.uk, the UK’s leading trading and investing reviews website. Check them out if you are looking for high quality traffic.

Welcome to The C-Suite, a monthly interview with leading executives in the retail trading industry.

This month we’re speaking to Michael Ayres. Michael is the CEO of Rostro Group, the company that acquired Scope Markets in early 2022. Prior to taking the CEO job last year, Michael had stints at several firms, including Equiti and FXCM.

To kick things off, can you talk about the distinction between Rostro and Scope Markets? So Rostro acquired Scope but are you a group level company with several brands beneath you? How does that work?

Correct, so Rostro Group is the holding company and beneath that sits our brokerage business. Rostro was set up in 2021 and at that point we had just one entity in Mauritius.

We were looking at going the organic route, so applying for licences and so on, but then also the other route of acquiring firms. Scope Markets came to us and through the due diligence process, we saw that there were a lot synergies with what we wanted to achieve, so we decided to acquire them.

Now we are also looking at other verticals, so things like payments and digital assets – but that’s down the line. For now Scope is our flagship brand and we’ve split that in two as well, so a B2C offering and a B2B offering.

How’s business in general at the moment? I get the impression it’s not very good for a lot of companies in the industry at the moment. Is that true for you guys as well?

The market environment is the same for everybody. That doesn’t change. But we run what I call a multi-book hybrid risk model. So effectively we don’t run a complete warehouse, typical A/B structure. My background is in operations and risk management. So I have quite a sensitive eye for diversification, concentration, how we’re running our business, irrespective of market environment, and the bit that’s not our hands.

So we’ve done okay this year. Business is going well, growth is going well. For us, this year was kind of an integration year. We’ve acquired Scope. Naturally, what comes with that is some changes, whether it be technology, hiring, people, processes, and so on. Given all of that has been going on in the background, we’ve had a good year.

That was a point that I wanted to pick up on. Looking at what’s been happening at Scope, it feels like a lot of housekeeping. So is that just part of expanding and setting things up or did you come in and saw there were things that needed to be changed operationally to improve the business?

It’s a combination. My background is operationally skewed, so I wanted to focus more on building and integrating initially. And now that’s almost done we’re working towards the external brand proposition and presence. I believe a lot in building a strong foundation. So having that foundation laid and then building on top of it, rather than focusing on the external straight away.

And how did you end up in the role?

I was at the point where I was open to exploring different opportunities. I’d known [Rostro Founder] Roger Hambury about six years prior to joining.

So we had some initial conversations, we shared similar approaches to how we wanted to do things – the hybrid structure, building progressively, focusing on getting quality people. And so we shared similar views to how to run the business.

On a personal level, I’d just had my son and it just felt like time to try something new and build something from the ground up.

One of the things I hear occasionally is that it can be difficult to make the move from being a more operationally minded or risk manager-type person, to being a CEO. If you’re in operations, you’re very involved with day to day tasks, so you might be on your dealers about managing your book, whereas in the CEO role you have to be a bit more high level and concerned with the whole business. Has that been the case?

It’s definitely been a transition and there are parts which have been trickier than others. But overall it’s helped a lot to have an appreciation for all the different parts of the business.

I’ve worked from back office in the early parts of my career, through to middle office, trading, risk, working with different technology providers in the space. And then on both the B2B and B2C side of things. So for me, I think I had quite a good grasp of what the 360, internal parts of the business were.

Now it’s more using that knowledge and to then map it on to what we’re trying to do strategically and using it to grow the business. So it’s been tricky at times but overall an amazing experience.

You’ve spent a lot of time hiring people, getting new licences and so on. What is the ultimate vision for the company? I mean what do you want to see Rostro be like, say five years from now?

From a branding point of view, we see there being two pillars – one is B2B and the other is B2C. B2C is primarily focused on emerging markets, which we’re set up to do with the licenses and the distribution channels that we’ve got.

B2B is a lot more balanced and a lot more globalised. So this is not just a standard MetaQuotes offering. We already offer cash equities, futures, and some other products. So from a product perspective, that’s something we want to focus on, in terms of giving people broad market access.

I would say we have an eye on what products we would like to add and where – geographically – we’d like to expand.

But you also have to take a step back and realise, ok, this is year one, we’re still in the early stages of what we want to do and lots of things can get in the way of that. So I don’t want to lose focus on that and I’d prefer to focus on making sure we’re doing what we need to do near term, rather than predicting where we’ll be in five years time.

So on the B2B side that you mentioned, it’s almost as competitive as the retail side. There’s so many people that have a Prime or Connect or whatever you want to call them, that caters to a B2B audience. So who are you going after there and is it broader than just the broker space?

It’s a combination. We do have retail broker customers but we’re also launching a fully-integrated portfolio management system. So through our license in South Africa, we will be targeting a wealth management customer base, which is quite different away from the retail broker arena.

We also have institutional business from Kenya under our CMA licence as well. And then we’re looking to do something similar to that with our CySEC entity in the near future.

So really it’s a mix. You have some brokers but also wealth managers and then some high net worth and professional traders.

This is always something I find interesting, where if I am one of those clients, there are still so many providers out there. So how do you stand out in that crowd?

One of my goals is to make sure we don’t end up in a situation where there is dilution of service. We almost don’t want to have as many customers on the B2B side as possible because service will potentially drop. So from our standpoint, we want to focus on service as the main factor.

Then you have the offering itself, so yes you have the CFD products. But then you are also getting competitive pricing in FX, a custom liquidity feed for indices, or access to cash equities for your customers.

So it’s really those two things, to build a sort of niche, tailored service to clients and to also provide a really high standard of service. The service component is a big one for me and of what we’re doing.

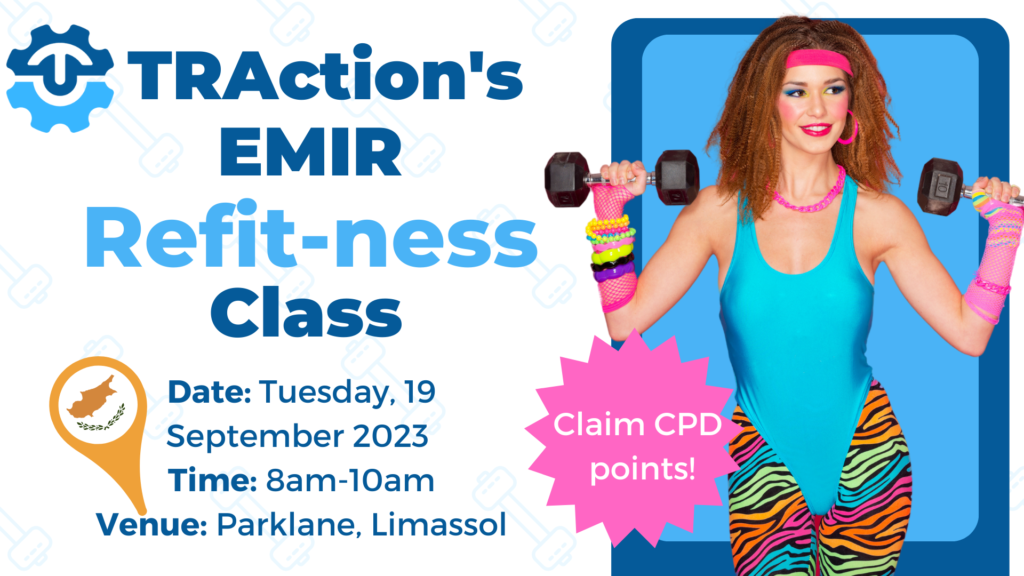

Join the TRAction team at Parklane next Tuesday in Limassol, share ideas with other leading executives and make sure you’re ready for EMIR Refit 2024. Sign up here to claim your spot.

Something you’ve alluded to is the fact you are active in emerging or frontier markets, particularly in Africa. If I look at this from a high level, you have a lot of countries where it can be really difficult to do business, regulation may not be fully formed, legal systems may not be on par with more developed parts of the world. So if I imagine I’m investing in a company that does business there, it’s not ideal. Are those fair assumptions and what does that actually mean for you as a company doing business in these jurisdictions?

From an internal perspective, we have really strong governance, principles and frameworks in place. So if you look at our Kenyan entity, you have non-executive directors, risk committees, and so on. So that’s all very consistent across the group and I’m very happy with how we are operating.

It’s true that different markets have different characteristics and I guess from that standpoint, you’d expect to see slightly different interests or behaviours from customers and so on.

But that’s true in developed markets too and we’ve found that we can operate in these regions successfully.

We were the second regulated entity in Kenya, and we’re one of the few that has the ODP license in South Africa. So we’re proud of those things.

As a follow up to that, you are also in markets where average incomes are lower but then they are also becoming hyper competitive. I guess you can say margins stay constant relative to wealthier markets because acquisition costs are also lower, but if that’s not the case, then are margins thinner and getting compressed as well?

I think this is where having the B2B and B2C business lines becomes a sort of USP for us. So if I take Kenya as an example, we have retail clients there but we also have local asset managers that are our clients. It’s the same in South Africa but with a wealth manager client base.

One area may supplement part of another over a particular period of time. Volatility may pick up or deplete and one might do better than the other. So that’s the idea for us, to keep these businesses running in parallel.

But I’d also say this is where having an operational background is useful, because there you have to focus a lot on cost. So, you know, margins come from two ways. It’s the top line and then it’s the opex.

What we control best is what we spend and how we spend it. So we’re very disciplined from an internal standpoint around that. We’re very, very strong at controlling and understanding our numbers.

Interesting. And so on the Kenyan front, your offering there is actually really broad, so you have local exchange-traded futures, cash equities. How much uptake has there been for those products?

Naturally the income yields are lower on those products. But we’ve seen quite lot of interest. We have a fair amount of equities trading in terms of volume. It’s also a product that we see as being a long-term focus for us. It’s not something we’ve added as an acquisition tool. We’re planning to continue and expand that as well via other entities.

So do you think the focus will just continue to be really be on Africa, or do you think you would look at places like LATAM, MENA, or ASEAN?

MENA’s definitely one that we’re focused on. That’s something that we’re looking at for next year and have some plans around, in terms of licensing and setting up an office in that region. That’s something we’re working on at the moment. So I would say MENA is the main focus at the moment.

If you look at MENA, it feels like every train station in Dubai is named after a broker and so many companies are going there. So what is the plan there?

What I would say is that Rostro Group is active in a lot of the M&A conversations happening in this arena at the moment. So we’ve had some discussions with specialist brokers that have taken market share in particular locations.

But we are also looking at other companies, so technology providers, companies in the digital assets space. So Rostro is open to conversations in this area is what I would say. Consolidation has been a theme for a long time but, from our standpoint, we believe it’s going to happen now.

One of the things you mentioned earlier was running a hybrid model. My sense is a lot of people running b-books on low margins are struggling. So is it just a case of you waiting around for ‘blood on the streets’ before you start buying?

Well blood on the streets might not help. But yea, if we are honest, it’s an environment that might favour distressed commercial opportunities that present themselves.

And for Rostro, we have our primary flagship brand. We have our operations hub. We have that infrastructure, so now if I can see that there are opportunities and people come to me to have conversations at points where their model hasn’t been sustainable during this period, then absolutely we’re here to have that conversation.

On that point, a lot of noise is made about doing complicated things from a dealing perspective to make your business more sustainable. Is there actually truth in that?

I’ve always been a strong believer in the hybrid structure. This is something I’ve always maintained and always believed in because it’s also about planning periods of time into the future of the business.

You need a high degree of confidence around cash flow, you need a high degree of confidence around margin efficiency. What you don’t want is a highly geared, highly volatile business model. Some might disagree and say that works, you just have to be patient. But from my standpoint, I prefer to look forward, so that you can see some consistency in cash flow, and you need to have a bit more of a disciplined approach for that to work.

So final question, you talked about expanding into other areas like payments and crypto or whatever you want to call it. When would those come online?

I wouldn’t say this year, but next year might be the time where we come forward with one of them. We won’t do both in parallel. so next year we’ll likely come forward with one.

At the moment we’re having conversations more around the acquisition path, so looking at businesses that are specialized, that maybe have a great product, great market fit, but haven’t got that go to market strategy correct or could take that forward with the distribution centres we have.

So that’s something we’ve already done in the past and which we continue to explore. But like I said, I think one of them will come next year.

Are you still actually seeing appetite for crypto though? Isn’t it dead?

Not in my opinion. I think it’s evolving. Regulation is obviously a point that has been discussed and has needed to come in for a while, just to get some level of control and maturity around it.

But from my standpoint, I think it’s an asset class that will continue to thrive and find its way into being here. You know, you have major exchanges offering Bitcoin futures. So I think it’s just in the process of being more settled and established, but it’s here to stay.