The way the ‘new’ prop trading model works is that clients pay to take a challenge. If they pass that challenge they are allocated capital to trade with. Profits they generate from subsequent trading activity are split between the prop firm and the successful trader.

Because the challenge component of this model takes place on a demo account, no real trades are placed and no client assets are held. The result is that, for trading challenges, there is no need for prop firms to meet trade reporting standards.

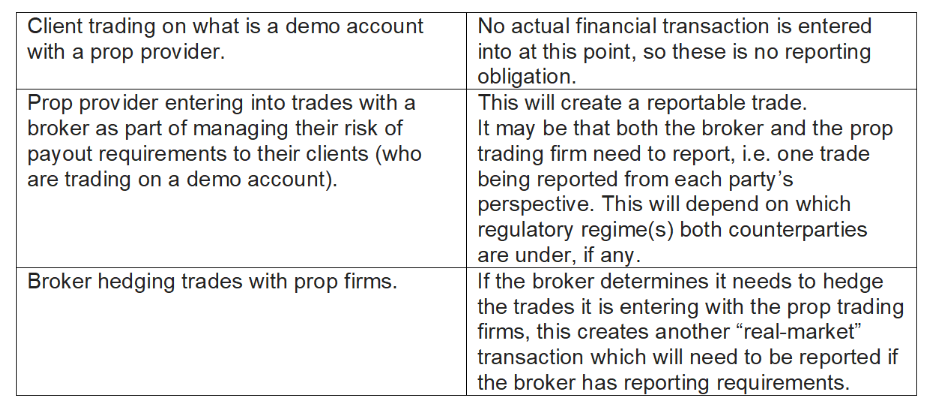

The second component is structured by different prop firms in varying ways. Regardless of how this is done, the end result is that a legitimate firm will have to place real trades at some point in time. How they do this will impact whether or not they have to meet trade reporting regulations.

“Based on the way prop trading has been described in court cases and the media, in most cases, a reportable trade will be created in one, if not two parts of the lifecycle,” said Quinn Perrott, Co-CEO of trade reporting firm TRAction Fintech.

Trade reporting rules for prop firms – mirroring trades

The most common model for props to follow is for successful traders to continue trading on demo accounts. The prop firm then mirrors some or all of their trades in a real money account operated by a corporate entity.

Trade reporting rules breakdown (Source: TRAction Fintech)

Assuming this entity is registered in a region where trade reporting rules apply, this would result in a reportable trade. Unless the prop firm’s own prime broker provides trade reporting services, the prop firm will have to report these trades.

Trade reporting rules for prop firms – real trades model

A more unusual model for props to run is to operate in the same way as a regular CFD provider. In other words, they provide customers with a real cash account and then trade over-the-counter with them.

Leaving aside the conflict of interest and swathes of other regulatory problems a company operating using this model faces, if we assume such a provider is on a b-book or matched principal model, they would have trades to report.

It is worth noting here that most CFD providers operating using the matched-principal model do not typically – and confusingly – meet the regulatory definition of matched-principal. This means they typically have to report two trades, rather than one. Any prop firm operating using the same model would be hit by the same requirements.

Trade reporting for prop firms on joint account

Some props claim, although it is hard to verify such claims, that they offer trades via some kind of joint corporate account. In this instance the trader is allocated real money to trade with. They then trade directly via the company’s prime broker (or whatever set up they have).

Again, this would create a reportable trade for the prop firm, assuming the prop’s prime broker is not handling trade reporting for them.

Trade reporting for props – final thoughts

The bottom line is that a legitimate prop firm is going to have to place real trades at some point. Assuming the prop firm is based in a jurisdiction where reporting requirements apply, those trades are subject to trade reporting regulations, just as CFD providers in the same markets are. A failure to meet such standards is likely to result in serious problems for props, whether it be fines or more serious problems for prop executives.