DXtrade lets clients trade with you via TradingView. Click here to learn more about the integration and how you can access over 50m traders in 200+ countries.

Data can be a fun thing to play around with. I remember in one job being amazed that our largest client lived on a rural council estate. Then I realised that I was looking at trading volume and not portfolio size. Big brain stuff. Things looked rather different when I made the requisite change.

On the other hand, techno-utopianists have been touting the benefits of big data since I started my career. Sometimes these benefits are questionable. A lot of the time data shills have many of the hallmarks of hammers looking for nails. Much like crypto people, they will start talking about the underlying technology a lot, leaving you with a brothy word soup devoid of tangible meaning and with few solutions to real world problems.

So what are some cool things that CFD providers can do with all the trade data they capture, other than meeting regulatory requirements? Read on and via this click bait-y style listicle you can find out.

1. Add market impact

As is probably apparent to most readers, there are a lot of companies setting up ‘funded trader programmes’ at the moment. One of the features of this business is that the vast majority of trading volume is synthetic – no real trades are executed.

This raises many interesting technical questions but one is how you would synthesise market impact if no trading is taking place. In other words, to create genuine trading conditions, you would have to be able to mimic the market impact that large size trades create.

This is something that FX/CFD brokers, from what I understand, also don’t do when b-booking trades internally. Maybe it’s not a problem but it feels like one of the ‘yea, that will probably be fine’ behaviours of some brokers who eventually blow up.

In some ways, this process resembles a GPT-like process. As a result it’s probably the hardest on this list to actually achieve.

“What you have to do is take your own execution data with LPs or buy third-party execution data,” said Boltzmann Research Co-Founder Chariton Christou. “You then train a machine learning model on that data, which then builds in market impact when clients trade with you in large sizes. We have experience of doing this but it is something very few brokers have done.”

2. Find out who is sharp and who is lucky

Sometimes clients make money. Sometimes they do this in a sneaky way. Other times they get lucky. And still other times they may actually just know what they’re doing.

Whatever the case, trade data is interesting to look at in this regard to see who is doing what and how to manage flow accordingly.

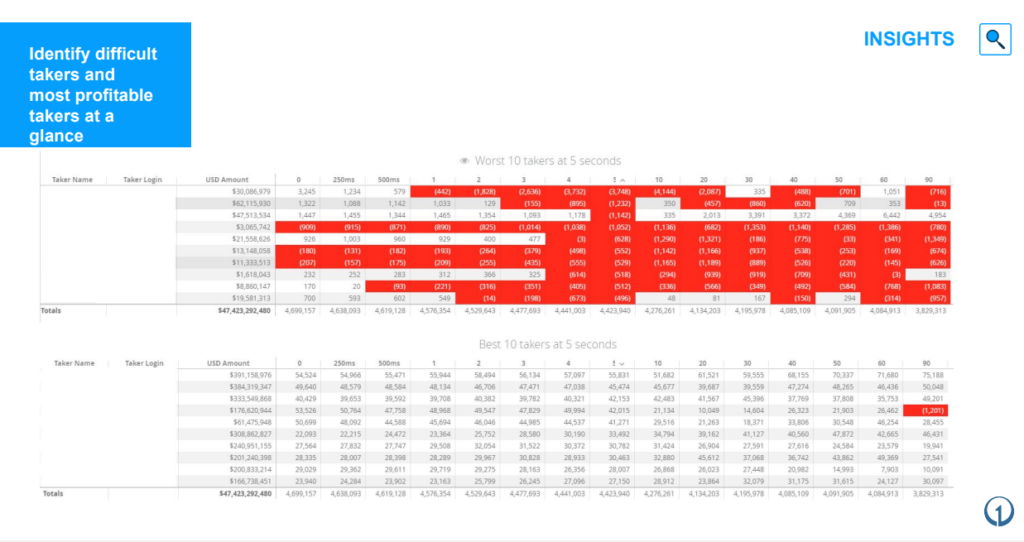

One way to visualise this is to map out mark outs of client order flow. In other words, from trade execution and then over different time increments, how profitable was a given client in a specific asset class or on an aggregate level?

You can see an example of this below, which is taken from oneZero’s Data Source, a data analytics tool for brokers. The top section shows profitable traders and the bottom shows unprofitable traders, with the profitability of trades shown in time increments that are visible along the top row.

This creates some interesting ways of managing flow. For example, someone who is consistently opening trades that are in the money immediately – as you can see in some cases above – is probably doing something scammy. On the other hand, someone that opens winning trades that move into the money more slowly may just be a more clued in client. But then others could also just be lucky.

“If a client’s profitability is the only data point being analysed then you simply aren’t looking deep enough at all the data available to make informed decisions,” said Amin Bellazrak, Director at Blackwell Global Investments.

“It’s important to differentiate between those who truly analyse trade data within their business and can justify their decision making, versus those who are on a streak of luck. After all, even a broken clock is right twice a day. Over a long tail, it quickly becomes apparent who is who in our industry. To put it simply, without using trade data effectively, no one can get lucky forever. “

The ability to look at client flow in this way can then also mean you change how you hedge out your flow. For example, if flow in a particular instrument tends to be profitable for you below a certain time increment, then warehouse it up until that point, just remember that caveat about past performance or whatever.

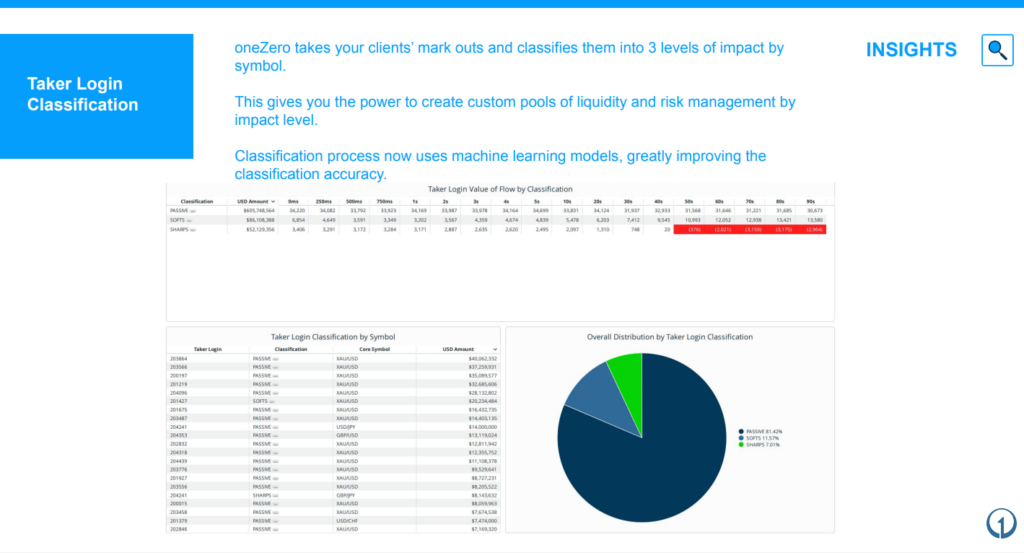

Another way of doing this is to break clients and/or instruments into categories and then hedge out accordingly. Brokers can do this themselves but there are also solutions where the process is automated. oneZero’s Data Source, for example, brackets individual clients into categories. You can then customise how flow is managed for them.

3. See what LPs are doing

Just as you can see what your clients are doing, you can also monitor what is happening with your LPs.

For example, you could look at the profitability of the flow you are sending to your LP. And then you compare the P&L on that flow to your rebates. Then you see there is a discrepancy. So you call up your LP and start saying stuff like ‘where’s my money bro’ and ‘pay me or else’.

Alternatively, you might realise that you could take on more risk than you thought you could – a big problem for many brokers, I’m sure.

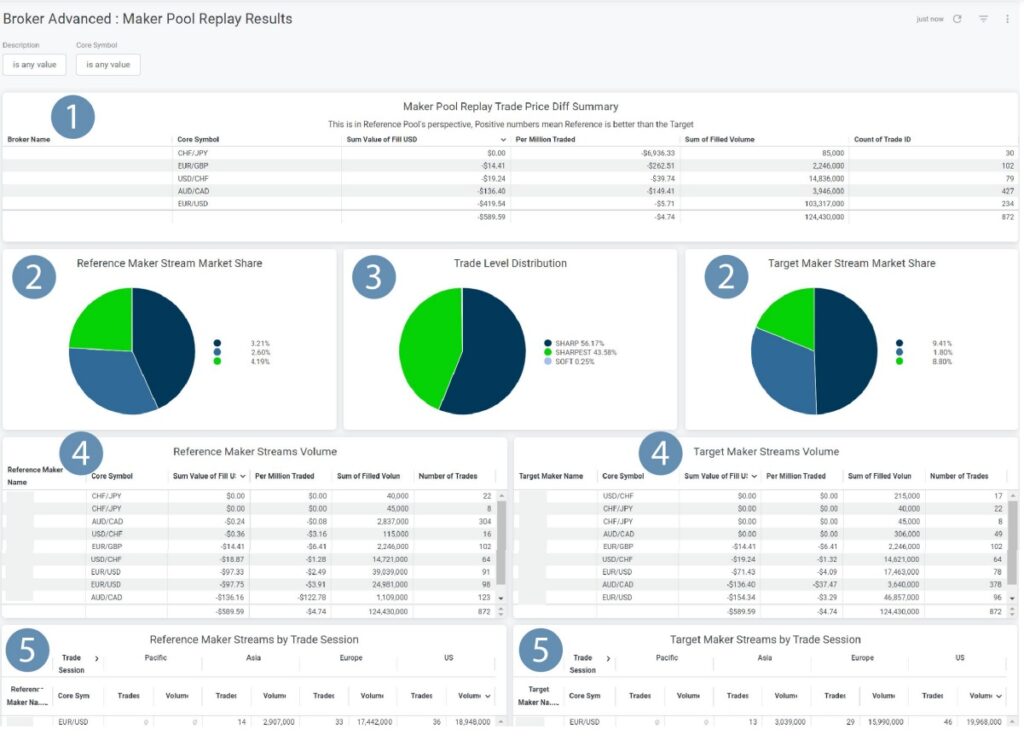

A more meta thing that you can also do, which again may be off limits to some providers, is to run back trades you have made and then monitor LP performance or simply see how trades were distributed among LPs.

Again, you could argue that there is a ‘past performance etc’ element to this but it is still interesting to see how things would have differed if you had executed flow X with LP Y, rather than whatever you did in reality. You can see an example of this in visual form above, again taken from oneZero’s Data Source platform.

4. Stop clients being annoying

One of the great things about capturing trade data is that you can stop clients from doing stuff like arbing you. And then when they come and claim that they weren’t arbing you, you can show them that they were.

Alternatively, even honest clients can get annoyed when they lose money and have a gut level reaction that they were somehow ‘wronged’. Again, the same principle applies here given that you can show on a very granular level how their trade was executed.

This is as much a public relations exercise as it is a technical one. Client complaints can cause a lot of damage, so being able to prove that your company hasn’t actually done anything is a big asset.

More to come

So there you have it – some cool things FX/CFD brokers can do with data. There is way more than that too.

For example, this author has often wondered if you could work out whether sending your worst flow to an LP would then result in worse pricing that results in higher costs for you, which would – perhaps counterintuitively – be more than if you had sent a mix of flow to that LP.

That’s one for another time.

IC Markets moves UK clients out of ASIC

One interesting development which took place last week was IC Markets shutting out UK clients signed up to its Australian entity.

Clients signed up to the broker’s ASIC-regulated operation were sent an email, informing them that their accounts would be closed.

“[A] business decision has been reached and unfortunately, we will no longer provide our services to clients from your country of residence,” the email noted.

As TradeInformer discovered this time last year, IC Markets does have a UK entity but this has not been approved by the FCA.

Clients that access the IC Markets website from the UK today are directed to the broker’s Seychelles entity.