One of the first articles published in this newsletter looked at CMC Markets. More specifically, I made the case that CMC was undervalued. So how did that turn out?

Oops. Yea, sorry about that. At least one reader managed to make a quick buck before things went south again. Maybe I should have done the same.

I don’t think so though and I’m (bag)holding because I think the company is still undervalued. My theory when buying above was that the company had bottomed out. Volatility had come down post-Covid and there had been a commensurate sell off, meaning CMC shares were down >50% from their all time high. You can see this in the chart above, as I published in April 2022.

On that point I was waaaaay off. The sell off still had a long way to go and here we are today. However, last week CMC put out a trading update and the shares are now up about 30% in the last month, so I figured it would be fun to revisit this point.

The reality is that not a lot has changed since that article. There are non-stock specific reasons why CMC Markets is undervalued. Part of this is just that the UK is a disliked market.

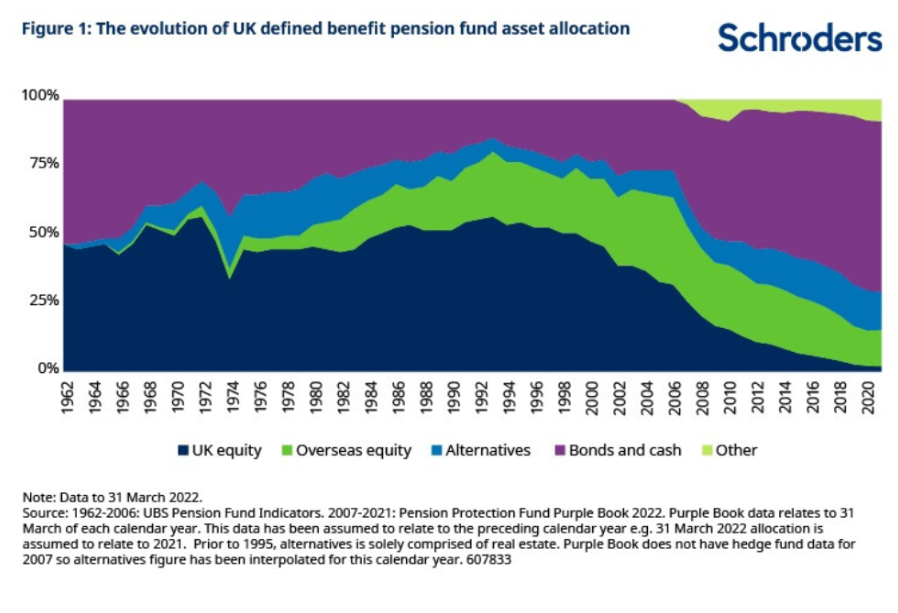

1. Pension funds moving out of UK equities

As you can see in the below image, a large proportion of UK institutional investment has been taken out of UK equities and into cash/bonds to meet liabilities. You can also see that equity investment became more skewed to overseas companies.

Share prices are ultimately a function of demand. When you remove a large segment of the market that buys, this pushes down demand. This alone has not been enough to compress valuations but combined with the dreaded b-word it seems to have played a role.

2. Brexit

Brexit was a vote that happened a few years ago and made a lot of people’s brains blow up, regardless of their political affiliation. One of the results of this explosion was a compression of UK equity market valuations. Note that this remains largely true, even accounting for the fact that the UK stock market doesn’t have the same number of growth-oriented businesses as the US.

3. Investors don’t like CFD stocks in general

All three of the UK-listed CFD companies trade on low valuations despite (as we’ll see) ostensibly attractive characteristics. There are regulatory reasons for this – the whole industry could blow up. There are also cash flow reasons for this. CFDs are basically dependent on market volatility that is hard to predict. This creates swings in earnings, which can be negative or positive, as we saw last week with CMC.

There are also reasons to not like CMC Markets specifically.

1. LCoS owns CMC Markets

CMC Markets CEO and Founder Lord Cruddas of Shoreditch (LCoS) owns >60% of CMC Markets. As a result, you could argue that CMC is close to not being a public company. LCoS controls CMC’s destiny. If you are a big shareholder, then you can’t do much to influence decision making.

2. There is no plan for what will happen post LCoS

LCoS cannot run CMC Markets forever and yet there is no clear plan as to what will happen if he decides to step down. This is also a problem for the first point. What if LCoS steps down but then he still owns the majority of the company? He can end up being like a proxy CEO.

Why is CMC Markets still undervalued then?

These are all fair arguments. My view on the valuation point is that this is basically not relevant to specific companies and is reflective of a wider malaise about the UK. This is often not backed by reality and, as a result, won’t last forever. Lies have short legs, as the Germans like to say. If you look at private equity and trade buyer takeovers in the UK, the average bid was at a 51% premium. Clearly there are still people that see value in the UK market.

Next we have the points on LCoS. These are more valid but don’t bother me that much, although I can see how they may preclude you from investing if you are a fund manager. I’m not voting in AGMs and broadly agree with the company’s strategy. I don’t think LCoS is going to suddenly dump all the shares and find it hard to see the company being taken over at a price per share below its current valuation, assuming that’s ultimately what ends up happening.

Then we look at the company valuation as a whole. Last time I wrote about CMC’s share price, the company had cash holdings equivalent to about 25% of its market cap. Today that figure is way higher and, based on CMC’s latest H1 report, cash holdings are just under 75% of its market cap. This is very high!

The other key point to keep in mind is that the company has close to £40bn in AUM in its stockbroking business. The downside is that this is in Australia, so there is less scope to grow this than in a market like the UK.

Nonetheless, this is a point that I continue to think is not appreciated by the market. As I noted in my last article on CMC, Abrdn acquired Interactive Investor when it had £55bn in AUM for £1.5bn.

The comparison doesn’t hold exactly because Interactive has been much better at grinding out revenues from its clients than CMC has. The next two – three years will be significant in this regard. If CMC cannot grow its revenue from stockbroking then I will be concerned and probably end up selling.

However, it’s also worth keeping in mind that Interactive Investor is a pure play stockbroker. CMC Markets has a whole other arm to its business that has, in good years, made more in profit than Interactive Investor generates in revenue.

And that part of the business is also growing reasonably well, particularly when you consider that CMC is in highly competitive markets and was hit with ESMA regulations in 2018. Revenue growth has been approximately 9% annualised since 2016, albeit with the huge caveat that earnings have surged and then come down again in that time due to Covid.

To me these three points really capture why I think CMC is still undervalued. You have a growing part of the business, which if it was a standalone company, looks like it should be worth more than it is, at least based on comparable valuations for similar firms.

But then those comparable companies do not have anything else attached to them as they are pure play stockbrokers. And yet they have higher valuations than CMC does, despite the fact the latter has an entire CFD arm that often makes more money than those companies do.

The other key point is that CMC has no debt and, as we’ve seen, is highly cash generative. This is more of a personal preference but I am a simple man and hate debt. If a company makes increasing amounts of cash and doesn’t use debt to achieve that, it’s a plus for me.

My guess is that CMC will, like all the CFD players, continue to see its share price correlate highly with market volatility. That comes in bouts and is hard to predict. But the long-term trajectory is to the top right of the screen. Fortunately I’m still under 30, so I can hold for a while. But if you are going to need your SIPP soon then maybe this one isn’t for you.