A few months ago a balding man wandered into the pristine offices of a company based near to St James’s Park. The elevator took him up to the third floor and opened out on to a room with polished white flooring and plants hanging from the ceiling.

“Hello?” Said the man. But there was no answer. He wandered around, his feet clacking against the ground. From one room he could hear someone swearing and shouting. He entered. A young man in a white hoodie sat playing FIFA 23 on a plasma TV. Bad Boy Chiller Crew was blasting out from a JBL Bluetooth speaker.

“Errr hello…” said the man. “I’m here for a surprise visit. Can I see your AML procedures please?”

“Yea, yea,” said the guy in the hoodie, shooing the man away with his hand. “Just give me one sec…I’m playing Manager Mode and I really need to win this game.”

“I kind of need to see it now,” said the man. “I’m from the FCA.”

The man in the hoodie paused the game, made a loud sigh, and rolled his eyes.

“Oh yea, you guys,” he said. “You’re like the police or whatever, aren’t you? Ok, fine, come with me and I’ll show you.”

The man in the hoodie took him to a square room – about 6ft by 6ft – that was tucked away at the back of the office. There was a piece of paper blue tacked onto the door, which someone had written ‘legal stuff’ in black marker on.

Inside was an empty crate of Heineken that had been turned upside down and was being used as a seat. There were also some empty packets of Adderall and a single Mac Mini that was hooked up to an old Sun Microsystems monitor.

“Yea this is where we do all those ALM things,” said the guy in the hoodie. “You know it’s funny actually, like, last time you guys were here, I remember you were all mad about the onboarding and everything. But we figured out if you just use a Club Penguin ID to do the KYC then it speeds up that whole process, you can hit all your north stars so easily.”

“Club Penguin?” Said the FCA guy, whose pulse was starting to race.

“Yea, you know, like the game,” Said the guy in the hoodie. “You basically connect your Penguin’s ID to your Google account and then you can use that to make your first deposit.”

“What penguin?” Asked the FCA man. “Who is in charge of this?”

“Oh bro that’s the best part,” said the guy in the hoodie, picking up a stray Heineken can and cracking it open. “No one! Basically we got a dev person to build an API for Chat GPT and if some bad thing happens then it auto flags it. Man, you should have seen it, the guy who built the system was cooped up in here for like 3 days straight, bugging out on Modafinil. I think he only ate one Pot Noodle the entire time he was in here.”

Yada yada yada the FCA weren’t happy about this situation.

Ok so that didn’t happen but one firm that did probably have problems with the regulator over the last couple of weeks was Capital.com. Followers of the much vaunted TradeInformer WhatsApp channel will have noted that you can no longer sign up to the company from the UK.

The text the company put out reads a lot like the stuff Trading 212 used to say when they mysteriously stopped onboarding anyone from the UK for over a year. There’s a whole story there involving Turnpike Lane, a shed, and Vanuatu, but that’s for another time.

What may have happened is that Capital got a voluntary application for imposition of requirements (VREQ). However, if that was the case then you’d see it show up on the FCA website, which it hasn’t.

Another alternative is that they got an s166. This could be imposed for a number of reasons but would not show up on the FCA website.

Some of you may remember that at school, people would not get expelled but ‘asked to leave’. The idea being that if you leave ‘voluntarily’, it looks better than the school kicking you out.

s166’s and VREQ’s are kind of similar in the sense that the FCA is not taking direct, punitive action against you. Instead, for a VREQ, you ‘voluntarily’ decide to stop engaging in some activity, until you can put whatever people/systems you need in place to do that activity. An s166 is different and involves someone being appointed by the FCA or the firm to see how one or more areas of the business are being undertaken.

We don’t know what the problem in Capital’s case is but if you are onboarding insane numbers of people, but don’t have the systems in place to do that to the FCA’s liking, they will come after you. It’s happened to Plus500 in the past and, as noted, T212. Now it has happened to Capital.

ASIC goes after offshore

One of the things that has happened since regulators around the world put in place restrictions on leverage is that firms have sent clients to offshore entities.

Regulators are not big fans of this approach, you may be surprised to learn, and something that caught our eye recently were upcoming changes to trade reporting standards in Australia.

These go live later this year and, as TRAction FinTech note on their website, will effectively compel brokers that take on retail clients from Australia to report the trade.

It is kind of hard to imagine what the intention of this is, other than to stop brokers from taking clients offshore.

Another facet of these rules is that they would require brokers either doing matched principal trading or hedging their exposure with an offshore entity to also report those trades.

“You read through the texts that ASIC has put out and it feels like a strong hint to the CFD industry to basically stop sending clients offshore,” said a regulatory consultant at one tech provider. “It’s hard to see any other reason why they would do that.”

Interesting times.

Americans like punting too

Something I have noticed in the CFD industry is a perception the US is somehow an ultra strict market where punting on financial markets is strictly prohibited and widely frowned upon.

As it pertains to CFDs, I would say there is actually a large group of people who do not like the idea of instruments that would otherwise trade on exchange being traded OTC. Hence why spot FX CFDs, where there is no underlying security which could be exchange-traded, are far easier to offer in the US.

But hey, what do I know?

Other evidence that this is a misconception continues to come out in the form of zero-dated options. Unlike Europe, binary options are still legal in the US and zero dated options bear a strong resemblance to them.

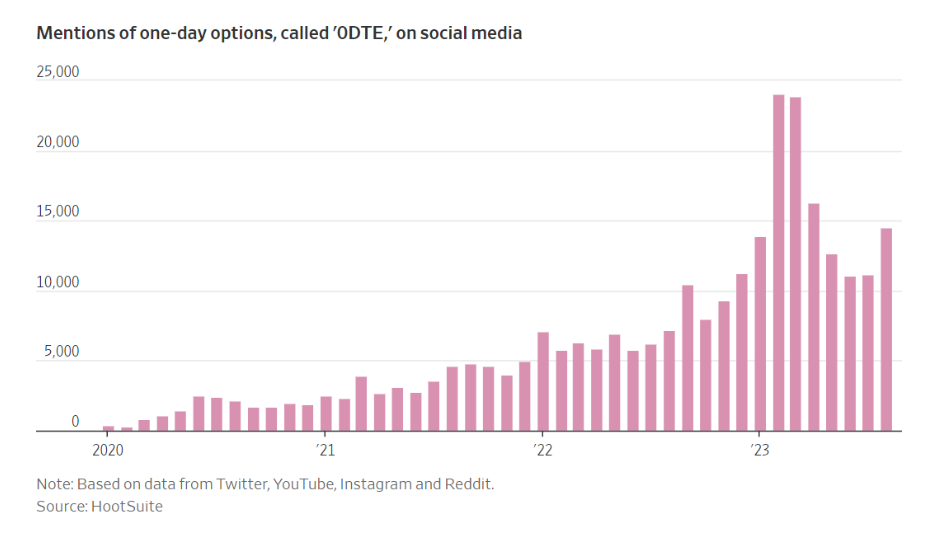

Effectively these are options with a same day expiry. As you can see above, in a picture taken from a recent WSJ article, they are becoming increasingly popular. Another WSJ article came out this week noting their surge in popularity.

If you look at Robinhood’s latest quarterly results then you’ll also see that $121m of the $200m they made in transaction-based revenues came from options trading. In contrast, stocks made ‘just’ $25m. Is this meaningfully different from a broker in the UK using commission-free equities to attract clients and then switch them into spread bets / CFDs?

I would say no. The loss rate is similar, the client persona is the same, the intertwining of gambling and finance is the same. And yet people in the CFD industry continue to act like this is something markedly different and the US market is way more sophisticated. Why?