DXtrade lets clients trade with you via TradingView. Click here to learn more about the integration and how you can access over 50m traders in 200+ countries.

TradeInformer now has its own WhatsApp channel. This is a cool new feature and we’ll be adding all the behind the scenes content you’ve been looking for there. I don’t know if you can have more than one channel with the same name but I have also taken the WhatsApp channel names for Plus500, IG Group, eToro, and a few others. What to do with those? We’ll have to see.

Check it out and then come back to enjoy this week’s post.

5 points from IG’s latest results

Sometimes when I sit down to write this I can’t think of anything. This is one of those weeks. But IG’s results came out recently and there’s quite a lot of interesting stuff in them, so I figured we’d go through those instead. Let’s get to it.

1. IG is launching its investment app in Singapore and the UK this year

Almost a year ago TradeInformer was the first to report that IG was planning on launching an investment app. That is now ‘official’ and the company said it will be launching it first in Singapore this summer, followed by the UK.

The company says simply that it’s a stock trading platform. The company will face some competition here as CMC Invest has already launched in Singapore and Saxo Bank has released a stock trading platform in the city state too.

2. Singapore was the biggest revenue generator per client

As we’re on the topic of Singapore, I thought it was noteworthy that the region was responsible for the highest level of per client revenue across IG in the first half of the company’s financial year.

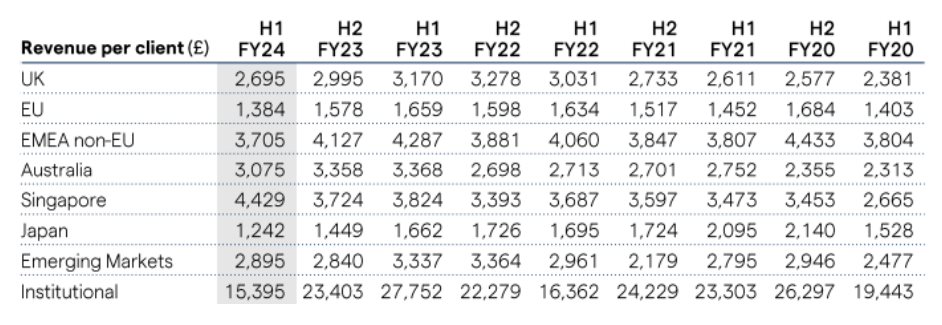

You can see in the below that per client revenue was close to £4.5k in H1. Also worth noting is the yuuuge drop off in revenue for institutional – the lowest levels in the whole period covered in the table.

Singapore has always been a good region for IG but if you look at the table, you can see it has consistently been second to EMEA non-EU, which is most likely dominated by the UAE. So rich people in Dubai have been punting less than rich people in Singapore (maybe).

3. A third of tastytrade clients aren’t from the US and people want to trade options

If you go on tastytrade’s website you’ll see there are almost no risk warnings, they offer deposit bonuses, and they have zero restrictions on signing up people from outside the US. They even did a huge talk here in the UK last summer, presumably to attract clients. So yea that’s totally fine but if readers of this newsletter do the same to US clients then they are toast. Shining city on a hill etc.

Regardless, one of the points I’ve been making since starting this newsletter is that options are a ‘thing’. This was always more based on a gut feeling from working at an investment platform during the pandemic and seeing what clients wanted. The general vibe was that there was a lot of demand for equities options but, beyond some anecdotes, I didn’t have harder evidence to back this.

However, IG’s now-departed stand-in CEO Charlie Rozes noted on the analyst call for these results that a third of clients to tastytrade come from outside the US. I’m sure that’s partly marketing. But to me that’s a fairly big sign that clients want to trade options.

What do South Park, DXtrade, and TradingView have in common? Read our latest guest post from DevExperts to find out!

Another sign of this is Rozes saying openly that they are seeing demand for this…

“Some of our most active clients outside of the US, for example, are keen for us to add options and futures,” he said.

Last week Plus500 launched CFDs on the VIX. TradeInformer is aware of one other provider that will be doing a similar product launch soon. The demand is there.

4. tastytrade is going to launch in the UK and Singapore later this year

Staying on the topic of tastytrade, Rozes also confirmed that IG is applying for licenses in the UK and Singapore for the options broker. The company expects the service to go live in the latter half of this year.

This is an interesting one because options, despite being a decent money maker, are never going to generate the same level of revenue as CFDs or spread bets. So if they supplant IG’s OTC offering then presumably that makes the business less profitable?

The other question is how this will work in practical terms. Rozes’ comments suggest this will be a standalone brand, presumably with intangible asset Tom Sosnoff leading the charge on the marketing side. One to watch.

You could also ask whether IG making less money overall as a business but from options, not OTC products, could actually make the company’s share price higher than it is today. If this sounds counterintuitive then compare IG’s market cap to Hargreaves Lansdown’s. The former makes more money than the latter. But HL makes its cash from share dealing and investors like this more for whatever reason. As a result HL’s market cap is almost 40% higher than IG’s today.

5. Big in Japan and marketing spend

Anyone who has been on the tube recently will have seen IG’s ads for its investment service. And if you look at the company’s accounts, marketing spend is basically flat on where it was last year.

However, the company noted that ad spend is being redirected away from acquisition and into brand awareness. Thus the tube ads.

Another interesting point here though was the company said it will be….

“…announcing a major long-term marketing sponsorship in Japan to help grow the awareness and strength of our brand. This demonstrates our commitment and belief that Japan is a market that offers IG huge growth potential on top of what we’ve achieved there already.”

What could it be? Cricket isn’t so big in Japan. Maybe those water cannons at the end of Takishi’s castle will have IG logos on them. A sumo wrestler perhaps?

Either way – see it, IG it.