I’m sure all of you spent 30 minutes last week reading through IG’s latest trading update, filled as it was with lots of inspiring corporate platitudes, stats on the relationship between content consumption and trading volumes, as well as an update on Spectrum.

One point which stuck out was the fact that interest income for the group totalled 5% of revenue in the first half of the broker’s financial year, or £24.2m in real money terms. That was a lot more than the equivalent period in the prior year when it was…0%.

Presumably the same phenomenon is affecting brokers across the board, with more income from cash holdings as interest rates return to their highest levels since prior to the financial crisis.

That could open the door to a cash product. For example, Interactive Brokers is already offering larger size accounts interest payments on their cash balances. For GBP, cash in excess of £8,000 receives 3.057% and the equivalent figure for USD balances above $10,000 is 4.08%.

I can’t see any broker offering this service in the CFD space aside from IB. It does seem as though that would be an attractive feature to offer clients though. Presumably if you can lure in more clients from doing so, then the amount it costs you can be offset against the revenue brought in by new clients.

Interactive Brokers’ offering also suggests it could be used to increase deposits, with interest only offered to clients depositing above a certain level.

From reading through the reports of the publicly traded firms, it seems most of them – as well as the analysts covering the stock – are only interested in this as a new source of revenue. But who knows? Maybe it will start being offered soon.

Are Plus500 shares undervalued?

One of the earlier pieces written in this newsletter looked at Plus500 and why I thought the company was undervalued. Since then the company has held its first capital markets day and rejigged its website to be a bit more friendly to investors.

It’s early days, so it hasn’t been long enough to judge whether the prior article was accurate, although readers are free to check performance since then if they like (just remember to make it total return).

The company released a trading update at the start of this year and it’s worth asking if the argument I made still holds. I think it does. The main arguments were…

- On a P/E basis Plus500 looks cheap. Even if its revenue halved, it would still be cheap.

- Despite having a low P/E, the company has good growth prospects

- By other valuation metrics (P/B, DCF) it is low value

- The valuation relative to cash holdings was very low

- The company has no debt and expansion efforts are not meaningfully impact dividends or buybacks.

Going through those points individually, I think they still hold. If you look at the company’s current TTM P/E ratio, it is barely above 6. According to Morningstar its forward P/E is 10. To provide some context on those numbers you can look at forward P/E averages on market indices below from Yardeni Research.

Based on the above, Plus500 shares are below, admittedly only slightly, the UK average and way below the US average. That wouldn’t be crazy if it was an average company with no growth prospects but that’s not the case, with Japan and the US still not factored into revenues in a meaningful way.

According to the company’s update, it also has more than $900m in cash. At market close on Friday the company’s market cap was £1.77bn – or approximately $2.135bn in USD terms. So 42% of Plus500’s valuation is backed by cash.

As such, I think Plus500’s profit could halve and its valuation would still be reasonable. If you look at the forward earnings multiple then that’s almost factored in. Alternatively earnings could stay flat and the share double and that would still be the case.

The main risks for the company seem to be…

- More restrictions on CFDs

- Failure in Japan and US

- Big drop in revenue because of lower volatility

In the near term the most likely of these is the latter, which tends to hit all CFD providers when they release trading updates or results. Fortunately the impact tends to be short-term.

However, the big question for the company over the next couple of years will be whether the US and Japan can become major revenue generators. If they don’t then you have to wonder what levers the company can pull to actually produce growth.

Does NAGA read CFDs Weekly?

Two weeks ago we looked at NAGA’s last set of company accounts and asked whether the level of revenue being reported might be inflated. We looked at some typos and rounding errors there too.

I went back to that document on Sunday and thought I’d clicked on the wrong reporting period. The opening page to the results was different to how I remembered it, as were a couple of other things. But after double checking, I saw that it was actually the one I’d been looking for.

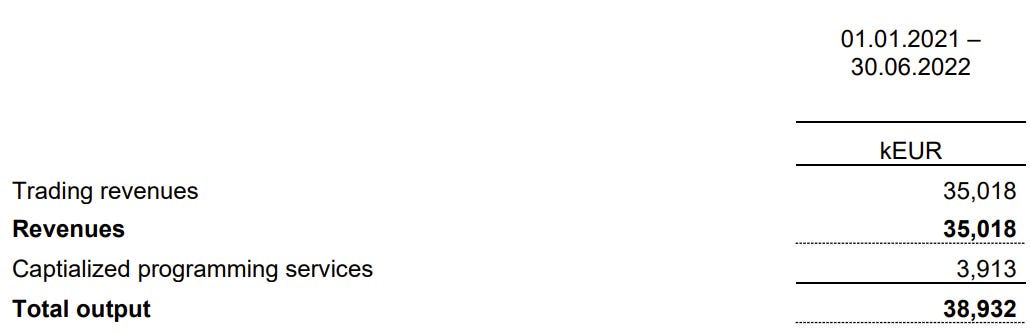

Scrolling down to the income statement again, it was clear the document had been changed. Below is a snippet from the income statement that was posted here two weeks ago.

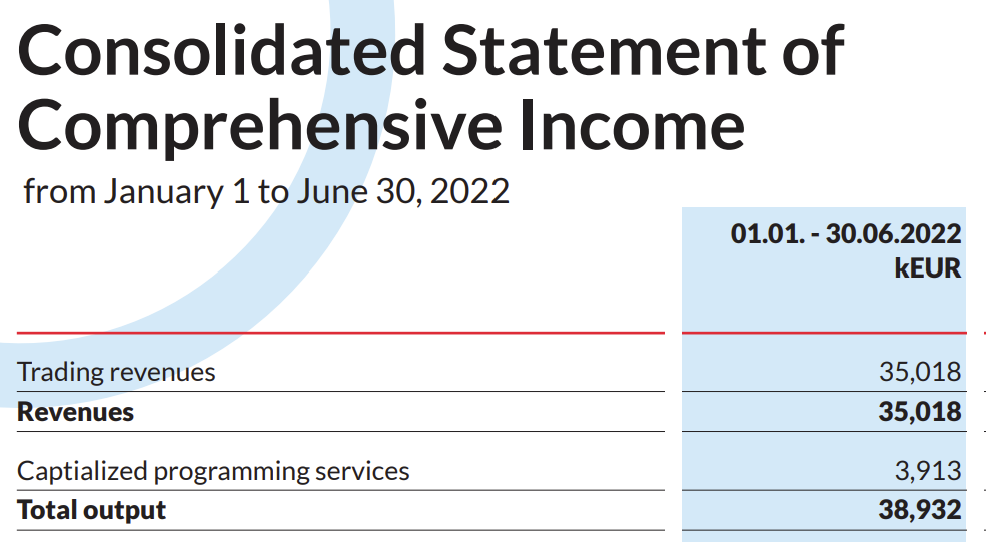

Then we have the same snippet from the page as it appears now…

Note that the date has been fixed, although the rounding error on ‘total output’ remains and ‘capitalised’ is still spelt incorrectly. Still, it’s another notch in the CFDs Weekly belt that we seem to have made a publicly traded company change its accounts.

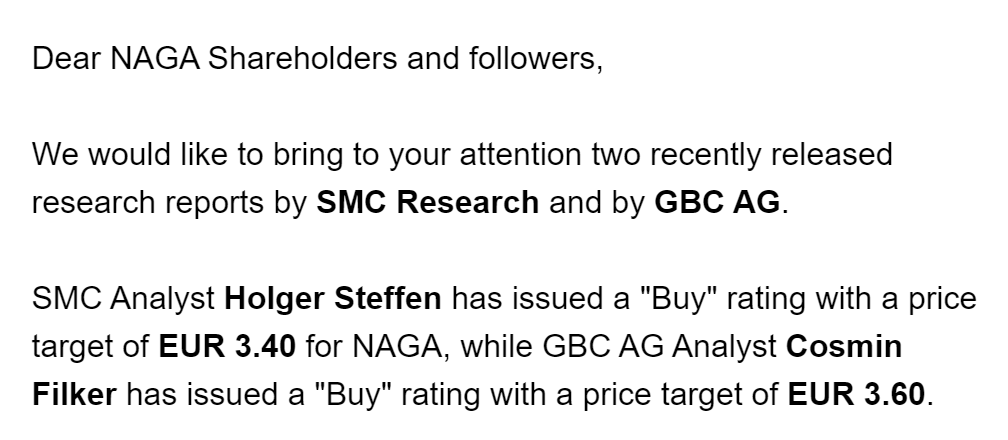

Part of the reason I went on there was because of an email NAGA sent to investors at the end of last week. You can see that below…

What this email doesn’t say is that….both of these reports were paid for by NAGA. Note that it’s common for small caps to pay to have research produced about themselves, so this isn’t unusual, even if the way it has been framed may be slightly misleading.

Emails like this, lots of updates in the news and a new monthly meeting for shareholders all seem geared to bump up the share price. Obviously most companies want to increase their share price but NAGA is really going for it. Why might that be the case? There’s one possibility.

In 2019 NAGA received investment from an asset management group called Fosun. Shareholders in the company were subject to a lockup period of three years. Or in more meaningful terms, company management couldn’t sell their shares until the start of 2023.

That must have been very frustrating, seeing as the share price has fallen by almost 80% since its peak in 2021. It may also explain why they’re now so eager to see it go up again.