One of the more enjoyable parts of writing about the CFD industry is the great lengths many investors and company shareholders go to in order to conceal the fact they actually own a particular business.

Sometimes this can be amusing. Many aeons ago the marketing person for a broker tried to get me to publish a piece about their new ‘prime-of-prime’ relationship. When I checked who owned the prime-of-prime, it turned out to be the same person that owned the broker, so it was basically a simple way of b-booking clients but making it look as though they were passing through trades to someone else.

I pointed this out to the marketing person, whose response was that the owner had nothing to do with the prime-of-prime, he was “just the majority shareholder” – a line so ridiculous it defies parody.

Anyway, I thought of this over the weekend when, like any normal person, I was browsing through some company registries in Cyprus. Despite not having the best reputation for corporate transparency, Cyprus does actually have an open registry of who owns what on the island.

One thing that piqued my interest was the profile of tech provider Tools for Brokers. In a sea of Russian names, one of the directors stood out – Campbell Millar (CM).

Who is CM? According to Bloomberg, he is Chief Operating Officer of the LMAX Exchange Group.

This is interesting. Why would the COO of LMAX be a director at Tools for Brokers, a position typically held by company shareholders? Well, digging deeper into the Cypriot documents, it turns out LMAX owns 20% of T4B Holding, the company which owns Tools for Brokers.

Tools for Brokers shareholders…

Maybe this isn’t new but I was unaware of it and have not seen it publicised anywhere else. So perhaps this post should have a big, bold EXCLUSIVE in its headline? I don’t know.

CM was appointed to a directorship role in 2020, so it seems unlikely the acquisition was undertaken recently. I also don’t know what LMAX’s goal is here – perhaps it’s to be the liquidity provider for Tools for Broker clients? Or maybe they have nothing to do with the company and they’re just a minority shareholder.

Adding equities is a regulatory arbitrage

Readers may recall the article published here a couple of weeks ago looking at Plus500 adding equities to their offering, whether it would actually be a profitable move to do so, and different reasons for them adding the product.

One reader noted that I’d missed an important point, namely that adding cash equities means you can get around regulatory disclaimer requirements on CFD products. This is true and something worth thinking about.

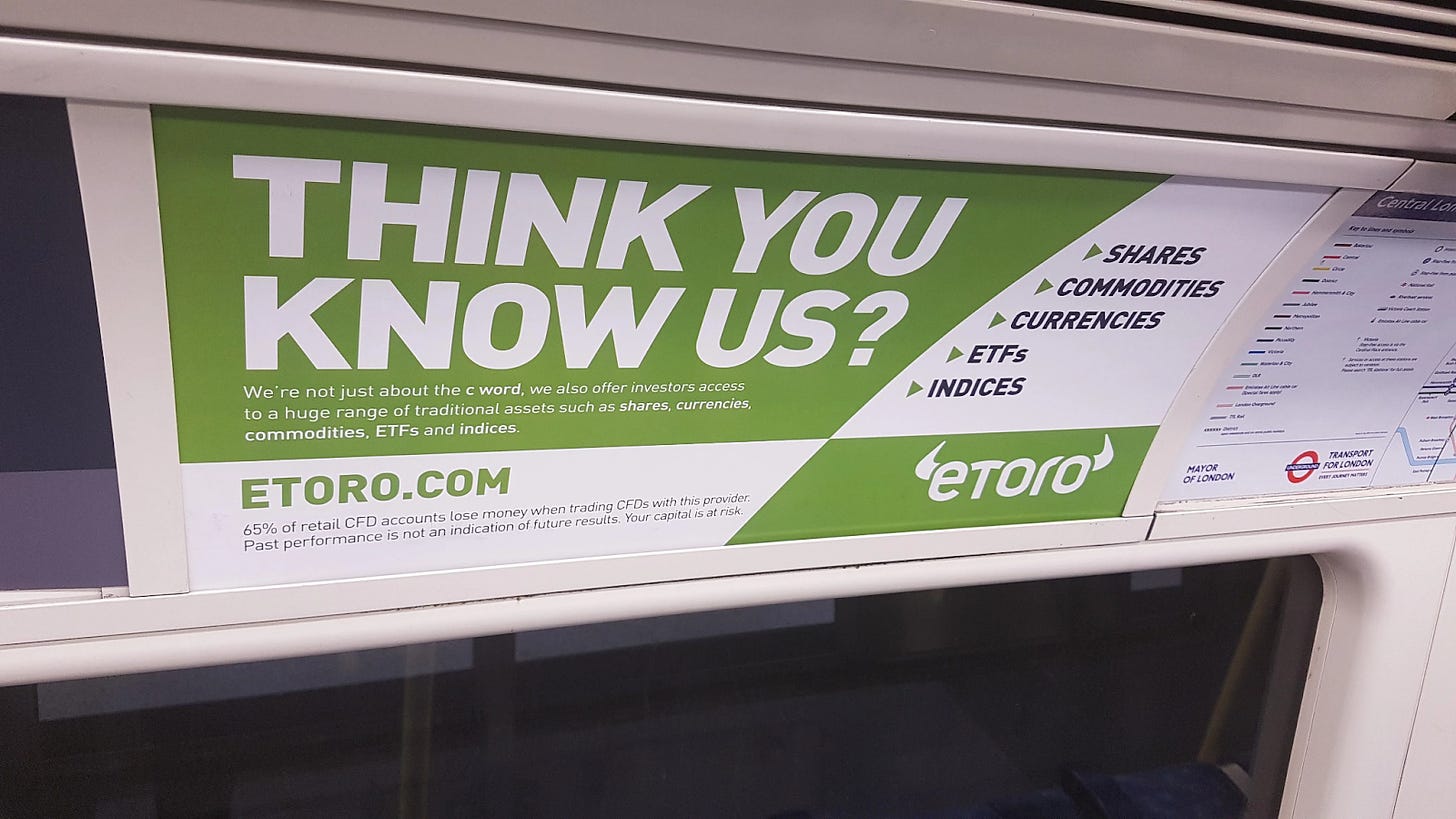

Fellow Londoners will have struggled not to notice the eToro / Pepperstone ads plastered all over the city’s underground network. Some of these cover CFDs and thus have to include the ‘X% of customers lose money’ warning. You can see this in the image below.

Others only market the company’s crypto or cash equities offerings. You can see these below too…

As you can see these two do not have the ‘X% of customers lost money’ warning. So adding other products also means not having to put in CFD risk warnings, which is a neat trick.

I would imagine this also applies to marketing spend. If you can compete on keywords in other products they may…

- Cost less

- You don’t have to put in the ‘X%’ warning requirement

This is a smart move. I always used to get Dianomi ads from City Index that would say something like…

“Trade CFDs with a leading provider (80% of clients lose money with this provider)”

Not a good look. If adding equities (or any other product) means you can get around the warning and those clients then go on to trade more profitable leveraged products, then it makes sense to add them, even if you don’t necessarily make money from equities themselves.

Trading 212 is coming back?

Bulgaria-based broker Trading 212 has not been onboarding clients properly in the UK for over a year now. This is usually a sign that something went very wrong with the regulator.

And indeed, reading the company’s latest yearly report we learn that, after experiencing the thrilling highs of meme stock mania in early 2021, “came the need for the [Trading 212] board to, voluntarily and temporarily, pause onboarding and reflect on the firm’s strategy and operating model.”

Now I could be wrong but there is a good chance that by “came the need for the board to”, they actually mean, “the FCA told us to” and by “voluntarily” they mean, “we had no other choice”.

It had been so long since this happened that rumours were swirling that the company wouldn’t be onboarding clients ever again. This does not appear to be the case as, according to the report, they are now onboarding clients again. They’ve also hired loads of people in the UK, which is not usually a sign you’re going to go out of business (although it’s not a guarantee that you won’t).

Another interesting part of the report details the manner in which equities trading is now carried out at the company. Previously, Trading 212’s equities offering was effectively a white label of Interactive Brokers (IB). This is, at least ostensibly, no longer the case.

They write that, as of last August, they are a ‘systematic internaliser’ for their equities offering, which is effectively a market maker.

It could be the case that they’re just plugged into other market makers (or just IB) and then have an execution engine to select the best price for clients. However, they also note that they hold inventory on their balance sheet, suggesting they’re acting more like a real market maker, and not just funnelling through trades to someone else. It could also be a combination of both.

It’s hard to say how profitable this will be moving forward. Trading 212 has about £3bn in AUM, so it’s hard to see how they could produce enough order flow on the cash equities side to be massively profitable – even if they were acting as the market maker on every trade coming their way. We’ll have to see what happens.