Ever since Robinhood launched its investing app in 2015, there has been a growing sense that adding cash equities to your existing FX/CFD offering is a ‘thing’ that you should do.

Some brokers, like Trading212 and eToro, have gone for it. Others, like Plus500, are in the process of doing it. A couple more, like FXCM and Markets.com, tried doing it and then stopped. And many other brokers seem to be not doing much about it at all.

The drive to try and tap into what Robinhood is doing has been a bit misplaced, mainly because…

- Brokers based in the European Union aren’t allowed to accept payment for order flow, which is the US app’s entire business model.

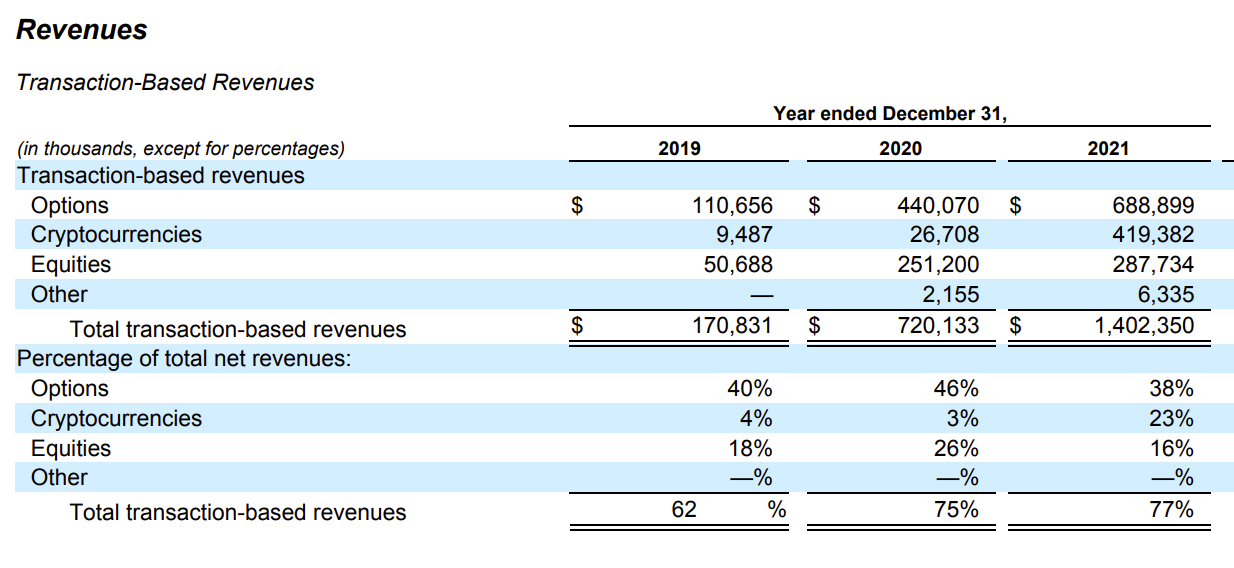

- Robinhood makes more money selling options and crypto order flow than it does from equities anyway.

Robinhood FY21 revenue from PFOF. Note that options is by far the biggest money maker.

But there are a few reasons why adding equities to an OTC derivatives offering may not be a great idea.

It’s annoying

Adding an equities investing option to your platform is a massive headache. Start with accessing the market.

In the UK, you can connect to the London Stock Exchange via the retail service provider network or get direct market access. Most brokers do the former and that means connecting to market makers. This can be a long process. You will have to do similar things for Europe and the US. It will also be a long process.

Alternatively you can plug into some other company’s API. For instance, it seems like Capital.com, eToro, Naga, and some others get their stocks through Saxo Bank. This may be easier but my guess is, like any white label-type product, it’s expensive to do and may give you less flexibility when it comes to adding other products of your own.

Once you do connect to markets, you’ll have to think of custody. You’re probably going to want to keep assets in a nominee account. But if you do that then you almost definitely won’t offer voting rights to customers on their shares. Those customers may be annoyed with you for this.

Accounts are also a pain. In the UK, most people want to invest using a SIPP or an ISA – two types of tax-efficient accounts. Adding either of these is a huge task, from a compliance and platform point of view. Also if your management team is not in the UK, you’ll have to explain what these are and then convince them it’s actually worth adding.

On a practical level, I don’t even think you could add ISAs or SIPPs if you only offer MetaTrader. And if you can’t offer them then you are unlikely to have long-term customers.

You’ll also have to hire a bunch of specialists who can handle things like transfers and reporting requirements, particularly for pensions. You can outsource some of this but it’s expensive and has the potential for additional headaches – IG has not been able to offer SIPPs for over a year because its provider stopped taking clients from them.

There are other accounts too, like lifetime ISAs and junior ISAs. Believe me, your customers will ask for them and will get annoyed if you don’t add them.

And remember, this is just the UK and these are just a few of the hurdles you’ll have to overcome if you want to add cash equities. Every country has its own type of tax-efficient account with its own nuances and legal structure. You will either have to outsource this or set up an office in each jurisdiction you want to expand into, assuming you want to offer a meaningful service there.

Finally, all of the above is ideally just an add-on. If you primarily offer CFDs then this is supposed to be a small part of what you do. Instead it can end up consuming all of your time.

Making money is hard

This may seem like a strange point to make. After all, if you look at established platforms in the UK, like Hargreaves Lansdown or AJ Bell, they make a lot of money, and have operating margins that aren’t too dissimilar from London-listed CFD providers.

The problem is the model they use is not one CFD providers seem keen on adopting. Like Robinhood, they want to keep costs low and not charge platform/custodial fees or trading commissions.

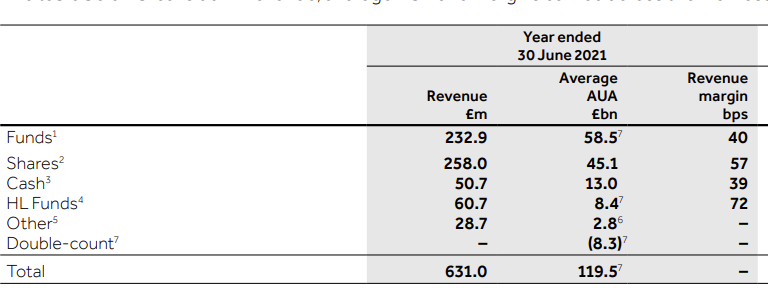

But if you look at Hargreaves Lansdown’s latest annual results below….

….you can see that the overwhelming majority of their revenue (funds, HL funds, and shares) came from commissions, fund management fees, and platform/custodial fees. So they made most of their money from things CFD providers don’t want to do or, in the case of funds, won’t be able to do.

It’s also worth looking at the revenue margin figures on the right. These are good numbers but it means you need a lot of assets under management to make money, even if you are charging these sorts of fees. Hargreaves Lansdown had almost £140bn AUM when this was released. In crude terms that means they made a little under 46bps in revenue from those assets.

There are other ways of making money that may be more appealing to CFDs providers. For instance, you can charge FX fees and widen spreads. As you can see above, cash in the bank also makes you some money, even if interest rates are low. But apart from widening spreads, none of these are going to make you a huge amount in revenue, and even wider spreads probably aren’t going to make you a crazy amount.

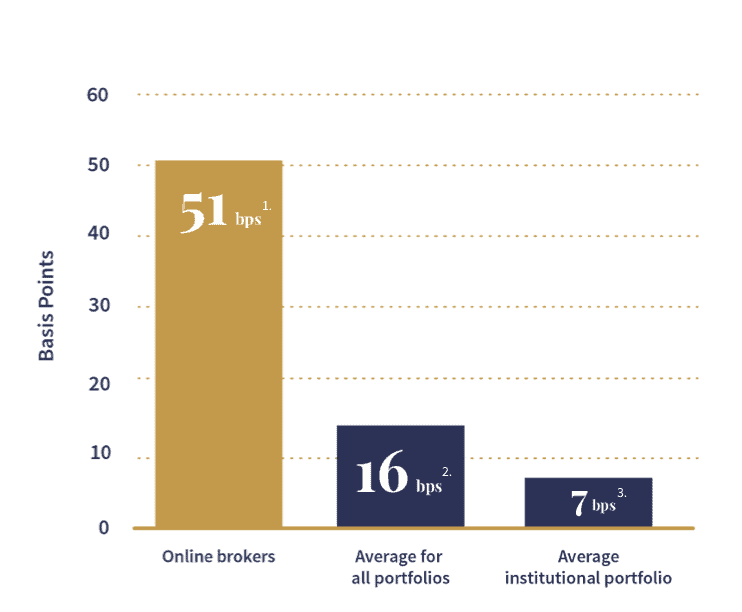

Average share lending revenue by client segment (source: Sharegain)

Another method may be to loan out shares to short sellers. This is a well-established practice in the US but is novel in Europe. Trading212 is doing it already and I wouldn’t be surprised if others started as well.

I’ll be interested to see if older brokers like AJ Bell and Hargreaves Lansdown adopt it. Sharegain, a company that offers the service, says you can make 51bps on client assets doing this (see image above), so maybe they’ll find it hard to resist.

Beef and milk

Bernard Lewis, a Middle East historian, has a great anecdote in his autobiography. He was visiting Egypt in the 1960s and struck up a conversation with a guy running a small shop.

This was at a time when the Soviets were becoming very influential in the country but it was also not so long after the British, whose last troops left in 1956, had been there. Lewis asked the shopkeeper how the two compared.

Both the British and the Russians treated the country like a cow, replied the man, to be used at their own convenience.

“The difference,” he added, “is that the British wanted milk. The Russians want beef.”

Leaving aside any relevance that may have to today’s world, it seems like a simple way of capturing the difference between long-term investing and punting on CFDs.

Stockbroker customers are very sticky. They often have retention rates above 90%. Like a cow being milked, they will give you drips and drabs of revenue over a long period of time. Even after they die, they may hand their assets over to relatives who may keep doing business with you.

CFD clients are the total opposite – and brokers actively encourage them to be. Plus500’s churn rate last year, for example, was over 30%. The year before that it was almost 70%, which is insane.

There is an upside to this, which is you will make a lot of money in a short period of time. But like someone raising cows for beef instead of milk, you are killing the client and will have to look for new ones immediately.

Changing this mindset is hard and it seems weird to offer both products at once given how different a mentality it requires.

Some companies do seem capable of it but I think CMC Markets is probably making a smart move by separating their CFD and stockbroking businesses into two companies (assuming they do it).

Others simply aren’t capable of making the change. I do not think a company regulated in Vanuatu, with a smoky, humid call centre somewhere in the Balkans and a CEO hiding somwhere in the Eastern Mediterranean, is likely to be interested in milking customers for the long-run. They want beef.

Maybe you still can do it?

Some people may have read this far and thought I’m being overly negative. I suppose the point I’m trying to make is not that you can’t add equities, but that it’s a lot of effort to do it well and if you aren’t willing to put in the effort then it won’t work.

I really can’t see what the point is in adding a white label GIA for UK customers, with no tax-efficient accounts. You aren’t likely to get any serious, long-term clients and it’s hard to see how you could make serious money doing it.

There is, however, one caveat to that. You may not actually care if you make money from equities!

A few years ago when I interviewed eToro CEO Yoni Assia at a crypto conference and asked him about whether they made money on commission-free trading, his answer was…

“We see commission-free trading as a great way to give a basic service and then to have more people enter the eToro platform and access more of our services,” said Assia.

“About 50 percent of clients that use our equities offering will go on to trade in other products, whether that’s crypto, ETFs or CFDs.”

Or in other words, offering commission-free trading is a good marketing tool. You could run a loss-making service but make up for it by cross-selling other products. Bux also said this explicitly in an old pitch deck, so it’s likely they have the same idea in mind.

My sense is that this may have worked in the past but it will ultimately produce diminishing returns. If everyone has the same offering, it ceases to be a good marketing tool. At the same time, a product that’s purely for marketing purposes is likely to be a crap product, and clients will catch on to that over time.

Of course, these two things are not mutually exclusive. You could make money from your equities business and have a useful tool to cross sell other products.

You can make a market

And one way you can make money is to make a market on your share dealing business. If you look at the way eToro executes trades for Europe and the UK, it seems like they are making a book on their share dealing offering via their Cypriot entity. They’ve also started selling order flow via their US entity but I doubt they’ll be able to do that with customers onboarded via their UK or Cypriot entities.

Trading212 is also making a market with its share offering. When you execute a trade with them it seems like they’re taking the other side of it or forwarding it to Interactive Brokers.

Trading212’s order execution policy.

I don’t know how either company manages the risk with this stuff but I guess it’s something along the lines of matching trades and capturing the spread or doing some kind of matched principal trade and adding a markup. Who knows?

Either way, it seems like it’s probably quite a good way of making money, although it may piss off some of their clients. But then they are paying no account fee, no commissions, and no custodial fee – can they really complain?

Annoyingly it’s hard to see the results here, as neither company states how much money they make from doing business this way. In theory it should be more profitable than payment for order flow though.

If you think about it, payment for order flow is a bit like a rebate from a market maker, who is giving you a kick back for helping them capture the spread. If you are the market maker then you are capturing the entire spread (potentially) and so stand to make more money.

eToro is going public soon, so maybe we’ll find out how effective this is. On the other hand, they do a huge amount to obfuscate how they actually make money and operate as a business, so I’m not holding my breath on that one.

Old school

Another option is to not try and cut costs like Robinhood. Instead, you just offer something akin to what Hargreaves Lansdown or AJ Bell do already. This is what IG, Saxo Bank, and CMC Markets appear to be doing.

To be fair, IG doesn’t seem to care much about share dealing and I’ve heard rumours it was deemphasised a while ago internally. When you don’t bother offering SIPPs for over a year, you don’t really give the impression you’re super committed to stockbroking. Still, they made £34m from share dealing last year, have almost 90,000 clients and, by my estimate, an average account size of £33,300.

Saxo also has about £72bn in AUM and about a third of their revenue comes from investing now. This seems to mostly come from trading commissions and platform/custodial fees.

CMC Markets is somewhat similar. It’s hard to work out exactly how much they have in AUM now but it could be upwards of £50bn. They also made 14% of their revenue (£54.8m) in 2021 from the business. Incidentally, whoever got their original deal with ANZ should probably get the biggest bonus in the company’s history – they’ve basically laid the groundwork for CMC to create an entirely new business that can be spun off.

Currently, CMC’s stockbroking business is only in Australia, although they’re planning on launching in the UK this year too.

I would argue CMC may be the most likely to succeed in the sector because they actually seem like they want to put the effort in and make it a business in its own right. As I said, I think CFDs and cash equities require two different mindsets and are really different businesses, so it seems much more sensible to try and run them individually, rather than bundling the two together.

Keep doing derivatives

So if you aren’t gonna do equities, what should you do?

My view is that IG, Plus500, and Tickmill have been smart in making big strides into futures and options trading, particularly in the US.

The lesson from Robinhood is not that commission-free investing is a great business, it’s that US options traders are effectively the American equivalent of CFD punters. This is where you can make a lot of money. But that’s an article for another time.

Have a good week everybody.

Stuff that happened: