Get more clients and boost retention with ForexVPS.net

Tech provider Match-Trade announced a new update on its trading platform at the end of last week. One key point here was the addition of a feature that lets a trader access Discord from within the company’s trading platform. From what I see (corrections welcome) this made them the first platform provider to do this.

Followers of the much beloved TradeInformer WhatsApp channel will have already seen some discussion of Discord and how it is becoming an important part of the prop trading business. And indeed, this was part of the reason behind the addition by Match-Trade.

“The decision to add a Discord login option to the Match-Trader platform was driven by its huge popularity among prop traders,” Match-Trade Technologies CEO Michael Karczewski told us. “Many props had already created dedicated channels, confirming a clear preference for Discord within the prop trading community. By allowing traders to log in using their existing Discord accounts, we significantly streamlined the onboarding process, similar to using a Google account for authentication.”

ATFX has big plans. Recent hires at the company – including FXCM Founder Drew Niv – have over 100 years of combined experience. Read all about it here.

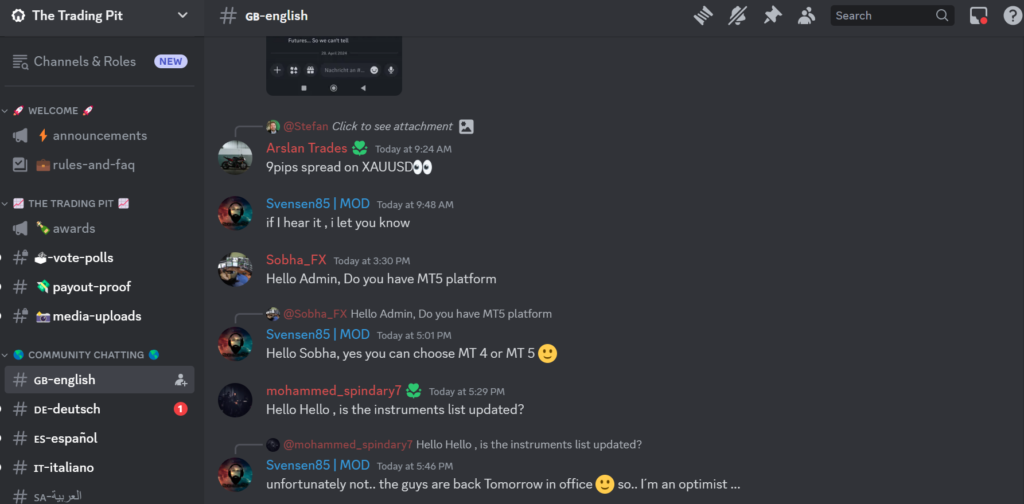

Much as we have enjoyed having a chuckle at the foibles of some prop firms, the use of Discord is actually pretty cool. In an industry where you can end up with a lot of stale-feeling products, Discord is a great way to engage with customers, tell them about products, and provide different educational content. Below, as an example, is the layout of the Trading Pit’s server.

Discord also has few competitors that offer a similar product. Slack, for example, is too pricey to run this kind of set up on. God help anyone trying to do it on the bug-filled hell that is ‘Teams’.

Other platforms also do not really offer an equivalent service. Part of the appeal of Discord is that it makes it simple to break up content into different areas that you can easily switch between. This is simple not viable on something like Telegram, for example.

However, the elephant in the room here is that this is very easy for props to do this because err…they aren’t regulated? Could you offer a similar thing if you were a broker?

“Forex brokers could derive similar benefits from using such a communication channel,” said Matc-Trade’s Karczewski. “Moreover, I believe traders themselves will force it, so whoever can better nurture their growing community will gain an additional edge.”

There is definitely a logic to this. To use a different example, we are seeing more providers add TradingView in some shape or form, purely because this is what traders want to do. And as Devexperts noted in a guest post on our site, doing otherwise is kind of like pushing water up a hill.

However, you would have to question how viable this is for brokers. For example, let’s say you are in the UK, would literally every post you make have to be reviewed by compliance and then have the cigarette pack risk warning glued on to it? Given a lot of Discord’s benefit is its speed and ease of access, this feels like it would be hard to reconcile with a highly regulated broker’s offering.

A discord server is also quite different from other social media in the sense that people can engage with one another much more easily and there is less differentiation between the company and the users. Again, just writing this you can hear the compliance team’s alarm bell system being activated and the cogs starting to turn.

Another factor, according to Rockqet Founder Desmond Leong, is that there is a difference between how prop traders behave and how clients trading with a broker behave.

“Prop firm and broker communities are so different,” Leong told TradeInformer. “Prop firm traders tend to interact a lot with one another. They share tips, trade ideas, technical problems and so on. Forex broker clients don’t really want to do that. What they want to do is speak to someone who is an expert. So someone that can talk to them about markets, provide trade ideas and so on.”

Leong’s company, which works with several large brokers and props already, provides ‘trading room’ technology that looks a lot like a Discord server. The difference is that it is more like a white label, meaning brokers can do more to customise the offering. According to him, this was mainly driven by working with brokers and props who wanted to avoid some of the problems they were facing with Discord.

“If you join a prop Discord channel then it’s not uncommon to be messaged within minutes by someone pretending to work for the company or someone else just trying to scam you,” said Leong.

“The other problems can be related to marketing activity. It could be something as simple as you want your branding to fit the Discord server. Well you can’t do that because you can’t change the Discord theme. Alternatively, if you are a marketer, you might want data on ‘ok, this client engaged with content X and went on to engage with us by doing Y’. That’s not really possible in Discord. So when we were building Rockqet over the course of a few years, it was like we were taking a lot of the elements brokers and props liked about Discord but removing all the ‘bad’ parts or adding features for this industry, whether that was for compliance or marketing teams.”

For what it’s worth, my two cents is that there is room for solutions like Discord and more personalised solutions like Rockqet. The problem for brokers would probably come from compliance requiring so many permission restrictions and other edits to the Discord channel that it would lose its efficacy.

WhatsApp growth

Another medium of comms that I find interesting, as illustrated by the highly respected TradeInformer channel, is WhatsApp.

Five years ago I thought Telegram would trounce WhatsApp because it had way more features and it felt like it had a lot of potential to improve those features / add to them. Reality turned out differently. From my perspective, Telegram did almost nothing in the last five years (hate mail welcome) to create new or interesting features, probably because Durov spends most of his time looking in the mirror and wandering around the desert with no shirt on.

In contrast, Zuck has implied that he wants to turn WhatsApp into something more resembling a ‘super app’ a la WeChat or Line. Both of these two latter companies are way more advanced, in my view, than anything you get from Meta-owned businesses.

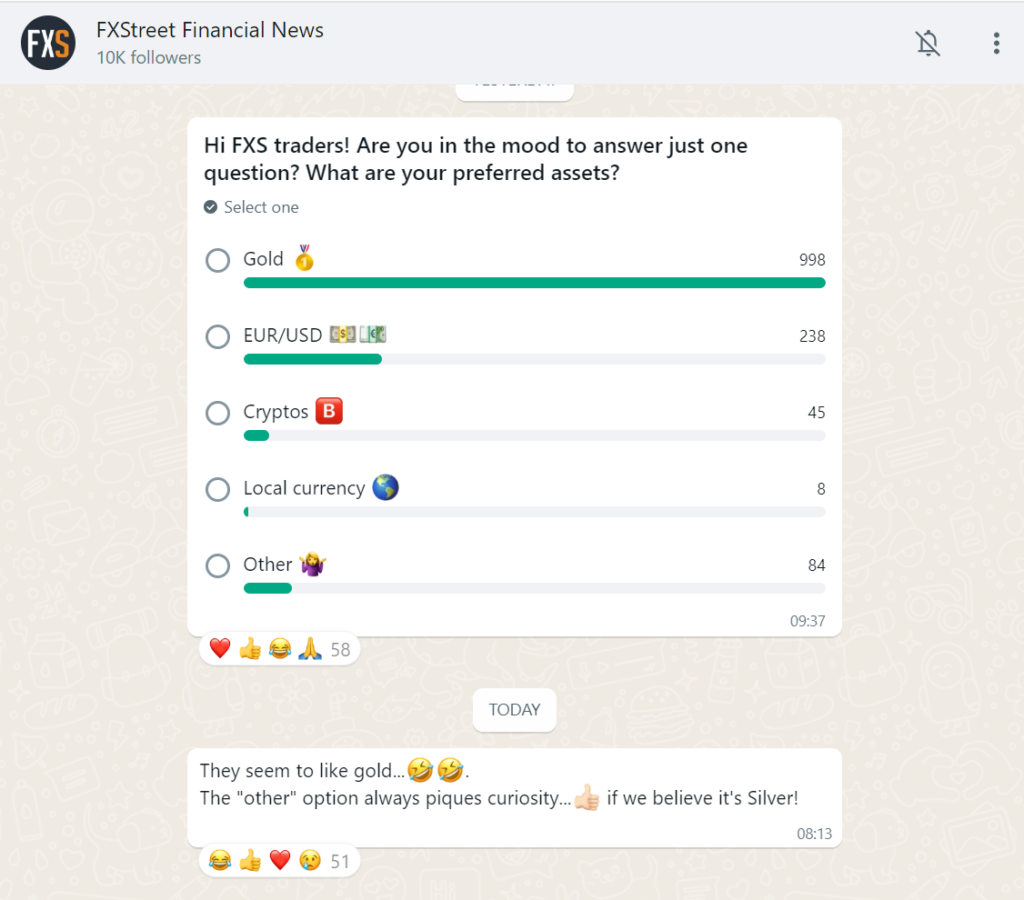

One sign of that development has been gradual development in business accounts and the ability to create channels. I’m probably wrong but I can’t see any brokers that have set up a channel yet. However, FXStreet has one with >10k followers.

To me this seems like a good option for brokers. It’s like X but you don’t have to see western civilisation collapsing when you go on it or Telegram but with less of a scam / 4chan vibe. From a compliance point of view, it’s also easier to manage.

Another option is to use WhatsApp as a way of communicating with clients. For instance, I saw one company called Voiso launched a feature recently which lets you send automated margin calls to clients via WhatsApp.

More broadly, it seems like a much simpler way to talk to clients in general. You can probably integrate it into something like Intercom (or similar) and then talk with people via the medium that they likely use most, given that everyone has their phone on them all the time and they check WhatsApp all the time.

“We are seeing a notable increase in demand for our services from leading brokers,” said Enis Mehmet, Co-Founder of Convrs, a messaging platform for marketing and sales. “WhatsApp messages boast high engagement with close to 90% open rates and over 40% click-through rates. Brokers are starting or expanding WhatsApp automation for key client interactions, including incomplete applications, accounts ready to fund, and reminders for inactive traders.”

The other positive about doing this is that you can avoid some of the more scam-type stuff that you get on other platforms. Firstly, on a WhatsApp channel, no one else can see who you are. So you can’t join and then get spammed by random scammers.

WhatsApp also appears to have a more developed authentication system for corporate accounts. Again, this helps to prevent scammers from impersonating you.

Finally, I would say anecdotally that Telegram has something of a bad rep in a lot of developed markets. I cannot imagine companies like IG Group or CMC Markets using Telegram consequently. However, WhatsApp seems more sanitised. Note this is not a judgement call on either app, just an observation. So I can see it appealing more to major brokers in the space.