It’s been a quiet week and so I figured we’d look into CMC’s latest set of results as there were some interesting points in there, even if they did come out close to a month ago.

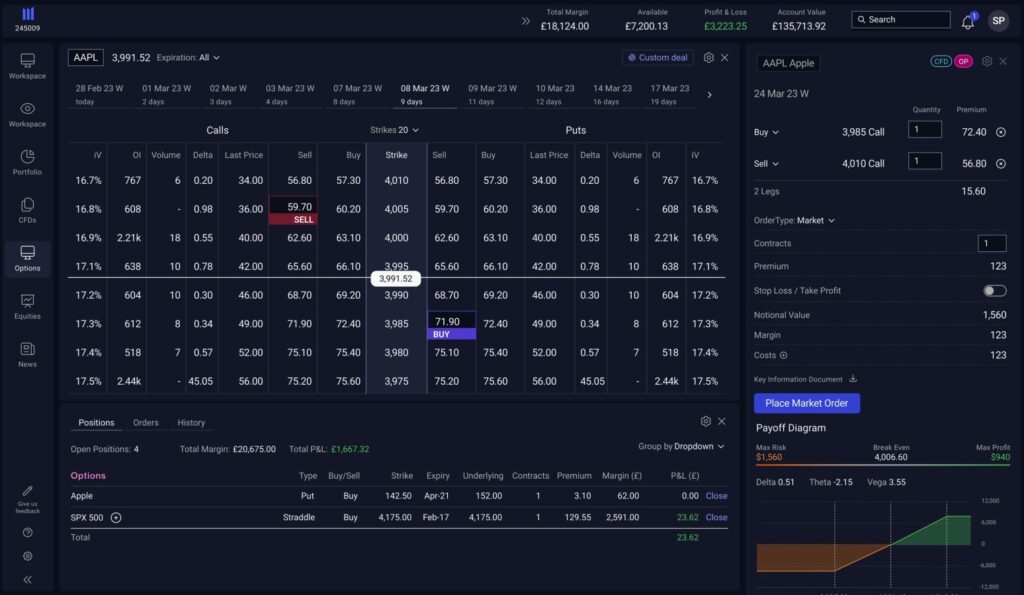

CMC will launch options trading in the UK this September

One of the arguments we’ve made here a few times before is that ‘options are a thing’. IG and eToro have added them in the US and are expanding abroad. Plus500 may try to do something similar, although for now they’re only offering futures.

Then you have other firms, like WeBull, who are expanding into other parts of the world with an offering that looks a lot like a CFD brokerage, except with options instead of CFDs.

CMC has said a couple of times that it was going to launch options outside of Australia where it has already done so for a few years. Now we have more concrete information on when that is happening.

In the company’s end of year report, the firm said they’d be launching in the UK in September with more plans to expand after that as well. And as CEO Lord Cruddas of Shoreditch (LCoS) noted on an analyst call after outlining CMC’s plans in this area, “we’ve got a great options team by the way. Premier league. Premier, premier league” – confidence instilled!

A couple of other points that I thought were of note here…

i) The plan seems to be to offer an OTC product rather than an exchange-traded one

ii) Options were the most requested product among CMC clients

CMC is launching an equities white label in the UK

One of the points I sometimes hear people in this industry make is that equities don’t make you money. This isn’t entirely true. For example, the major pure play retail stockbrokers in the UK (HL, II, AJ Bell) make lots of money, with high margins.

The difference is that it is much harder to scale quickly. For instance, you might be able to start a CFD shop today and, assuming you had solid backing, be making a lot of money very quickly. You can’t really do the same with equities because you have to build up AUM, which can take decades to do.

This is part of the reason CMC’s expansion into the sphere via B2B partnerships in Australia was arguably quite a smart play. They have managed to build up a lot of AUM over a short period of time via a small number of partnerships.

And the company is apparently trying to do the same thing in UK. On the analyst call for the results, LCoS noted that they are already in early stage talks with at least one financial institution to provide a white label product in the UK. From the way he described this company, it did not sound at all like another CFD provider.

The all in one platform

When we spoke to Capital.com CEO Peter Hetherington earlier this year, one of the points he made was that he ultimately saw the company becoming a ‘super app’-type thing, which you could use to manage all of your finances, except maybe your bank.

This was pretty much exactly what LCoS said that he envisaged CMC Markets becoming over the next three years, when asked by one analyst what he expected the company to look like in the near-term, given the large number of products the company is adding.

“We want to build the de-facto financial portal that you go on to every morning and you can see everything you need to see,” said LCoS. “So open banking, you can see your bank accounts on there, you can see your investments, you can see your tax returns, you can see your portfolio, you can drag and drop your portfolio….You’ll have multi-currency accounts, you can move currencies around. You can see your debit and credit cards. We don’t want you to go anywhere else other than our financial portal and we’re going to keep investing in that.”

Given that LCoS and Hetherington said that, and IG is also launching some kind of investing app, it seems this may be more of a ‘thing’ than I had previously anticipated it would be. I think the things to watch here would probably be…

- Dev costs vs returns. Things like portfolio management tools and integrating open banking APIs require initial investment + maintenance, but do not deliver much in the way of returns. For example, Revolut is a great app to manage your money but it is loss making as a business.

- Incentives. This really follows the first point, which is if you want to get someone to manage their finances with you, but CFDs are your biggest money making product, then presumably you’ll push them to trade CFDs. But if that’s what you’re doing then the incentive to keep money with you goes down.

Crypto optionality

A month ago CMC announced that they were taking a 33% stake in StrikeX, a company active in the crypto markets, something that made me wonder whether I should sell my shares in CMC.

What is reassuring is the way this deal was framed in the annual results.

Firstly, when that deal was announced, neither party stated how much it was worth. CMC’s annual report shows it cost them £2.8m. Not a lot for a company that made over £40m last year and has in excess of £300m in retained earnings.

Then there was the way this investment was framed in the company’s financial report.

They wrote that: “StrikeX gives CMC relevance and optionality” (emphasis mine).

In other words, crypto might end up being a load of rubbish but if it’s not then we have made an investment that can deliver high returns for a low cost. Makes sense.

Robinhood is coming to the UK

Robinhood was supposed to launch in the UK about three years ago but pulled out because the FCA was probably going to stop it from doing payment for order flow. Incidentally, the EU just banned this, which makes you wonder how Trade Republic is going to make money now.

But Robinhood is now back, with CEO Vlad Tenev saying in a recent earnings call with analysts that the firm plans on launching in the UK by the end of this year. You can see what he said below:

Robinhood’s UK entity currently only lists one executive – Bert Van Delft. Van Delft was previously at BinckBank for close to a decade and left just prior to its acquisition by Saxo Bank.

Assuming this launch does happen, the thing I’ll be interested to see is…

- How they make money given PFOF is banned

- If they launch options

- What happens to marketing spend

With regard to this last point, Robinhood is in a weird position. It continues to be massively loss making (it is only cash flow positive by paying >$500m of its salaries in stock options) but it is also sitting on $6bn in cash.

So if they do launch in the UK, presumably they will have a lot of money to start chucking on marketing spend, which is then likely to make life more difficult for…lots of people reading this newsletter. Enjoy guys.

BDSwiss partners with daughter of ex-president of Philippines

Sometimes people ask what the motivation behind CFDs Weekly is and, let’s be real, a lot of it is gold like this.

Last week people from BDSwiss posted photos with someone that appears to be their newest partner – Veronica ‘Kitty’ Duterte, the daughter of former Philippines president Rodrigo Duterte.

I don’t know how this happened but I like it and would like to see it happen elsewhere – eg. maybe IG can partner with Prince Harry or Plus500 can use Yair Netanyahu as an affiliate.

Duterte (the daughter) has over 1m followers on her Instagram page, where she mainly posts about fashion brands. Presumably she also has strong opinions about cable and NVIDIA’s valuation that she’s been holding back on. I’m sure you’re all looking forward to hearing those as much as I am.

Duterte (senior) was famous for his many epic quotes that were part Robocop, part Idi Amin. For example:

“If you are corrupt, I will fetch you using a helicopter to Manila and I will throw you out. I have done this before, why would I not do it again?”

Or

“Just because you’re a journalist, doesn’t mean you’re exempted from assassination.”

Better pay those rebates on time guys!

1 Comment

Pingback: Spain’s CFD ban - CFDs Weekly